Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

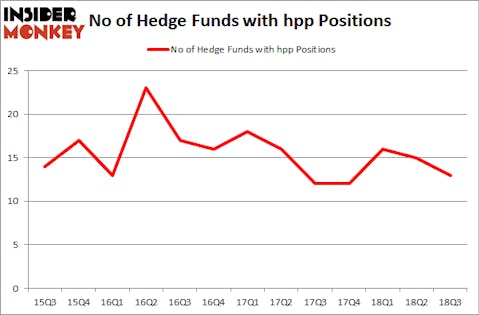

Is Hudson Pacific Properties Inc (NYSE:HPP) a buy here? The best stock pickers are taking a pessimistic view. The number of bullish hedge fund bets dropped by 2 in recent months. Our calculations also showed that hpp isn’t among the 30 most popular stocks among hedge funds. HPP was in 13 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with HPP positions at the end of the previous quarter.

At the moment there are tons of indicators shareholders can use to appraise their stock investments. Some of the less utilized indicators are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace their index-focused peers by a solid margin (see the details here).

We’re going to analyze the key hedge fund action regarding Hudson Pacific Properties Inc (NYSE:HPP).

How are hedge funds trading Hudson Pacific Properties Inc (NYSE:HPP)?

Heading into the fourth quarter of 2018, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in HPP heading into this year. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, managed by Jim Simons, holds the number one position in Hudson Pacific Properties Inc (NYSE:HPP). Renaissance Technologies has a $54.9 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is John Khoury of Long Pond Capital, with a $37.2 million position; the fund has 1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Eduardo Abush’s Waterfront Capital Partners, D. E. Shaw’s D E Shaw and Ken Griffin’s Citadel Investment Group.

Because Hudson Pacific Properties Inc (NYSE:HPP) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of money managers that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, Matthew Tewksbury’s Stevens Capital Management cut the biggest stake of all the hedgies monitored by Insider Monkey, totaling about $2.3 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also cut its stock, about $1.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Hudson Pacific Properties Inc (NYSE:HPP) but similarly valued. We will take a look at Core Laboratories N.V. (NYSE:CLB), FibroGen Inc (NASDAQ:FGEN), Lions Gate Entertainment Corporation (NYSE:LGF-B), and Euronet Worldwide, Inc. (NASDAQ:EEFT). This group of stocks’ market caps match HPP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLB | 14 | 247330 | -3 |

| FGEN | 17 | 467970 | 0 |

| LGF-B | 14 | 478134 | -1 |

| EEFT | 24 | 213065 | 6 |

| Average | 17.25 | 351625 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $352 million. That figure was $212 million in HPP’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand Core Laboratories N.V. (NYSE:CLB) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Hudson Pacific Properties Inc (NYSE:HPP) is even less popular than CLB. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.