After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of June 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Gaming and Leisure Properties Inc (NASDAQ:GLPI).

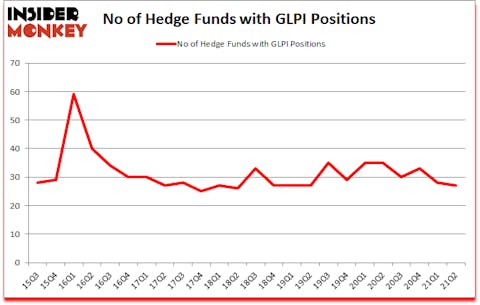

Gaming and Leisure Properties Inc (NASDAQ:GLPI) was in 27 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 59. GLPI has experienced a decrease in enthusiasm from smart money recently. There were 28 hedge funds in our database with GLPI holdings at the end of March. Our calculations also showed that GLPI isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Joel Greenblatt of Gotham Asset Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to view the recent hedge fund action surrounding Gaming and Leisure Properties Inc (NASDAQ:GLPI).

Do Hedge Funds Think GLPI Is A Good Stock To Buy Now?

At the end of June, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the first quarter of 2020. On the other hand, there were a total of 35 hedge funds with a bullish position in GLPI a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in Gaming and Leisure Properties Inc (NASDAQ:GLPI) was held by Gates Capital Management, which reported holding $181.8 million worth of stock at the end of June. It was followed by Cardinal Capital with a $92.9 million position. Other investors bullish on the company included Citadel Investment Group, Millennium Management, and Waterfront Capital Partners. In terms of the portfolio weights assigned to each position Gates Capital Management allocated the biggest weight to Gaming and Leisure Properties Inc (NASDAQ:GLPI), around 5.24% of its 13F portfolio. Waterfront Capital Partners is also relatively very bullish on the stock, earmarking 2.59 percent of its 13F equity portfolio to GLPI.

Because Gaming and Leisure Properties Inc (NASDAQ:GLPI) has witnessed declining sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few fund managers who sold off their full holdings heading into Q3. It’s worth mentioning that Parag Vora’s HG Vora Capital Management dumped the biggest stake of the 750 funds followed by Insider Monkey, worth about $74.3 million in stock, and Stuart J. Zimmer’s Zimmer Partners was right behind this move, as the fund cut about $42.4 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Gaming and Leisure Properties Inc (NASDAQ:GLPI). We will take a look at Jazz Pharmaceuticals Plc (NASDAQ:JAZZ), Cleveland-Cliffs Inc (NYSE:CLF), Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI), Marathon Oil Corporation (NYSE:MRO), PRA Health Sciences Inc (NASDAQ:PRAH), The Scotts Miracle-Gro Company (NYSE:SMG), and Deckers Outdoor Corp (NASDAQ:DECK). All of these stocks’ market caps are similar to GLPI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JAZZ | 34 | 1493732 | -3 |

| CLF | 44 | 1111037 | 8 |

| MRVI | 20 | 572985 | -6 |

| MRO | 34 | 655729 | 5 |

| PRAH | 43 | 2995527 | 8 |

| SMG | 32 | 369779 | -2 |

| DECK | 44 | 1473505 | 4 |

| Average | 35.9 | 1238899 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.9 hedge funds with bullish positions and the average amount invested in these stocks was $1239 million. That figure was $516 million in GLPI’s case. Cleveland-Cliffs Inc (NYSE:CLF) is the most popular stock in this table. On the other hand Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) is the least popular one with only 20 bullish hedge fund positions. Gaming and Leisure Properties Inc (NASDAQ:GLPI) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for GLPI is 32.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24.9% in 2021 through October 15th and still beat the market by 4.5 percentage points. A small number of hedge funds were also right about betting on GLPI as the stock returned 6.5% since the end of the second quarter (through 10/15) and outperformed the market by an even larger margin.

Follow Gaming & Leisure Properties Inc. (NASDAQ:GLPI)

Follow Gaming & Leisure Properties Inc. (NASDAQ:GLPI)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Construction Materials Stocks To Buy Now

- 15 Largest French Companies by Market Cap

- Billionaire Izzy Englander’s Top 10 Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.