Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. In this article we are going to take a look at smart money sentiment towards Alaska Air Group, Inc. (NYSE:ALK).

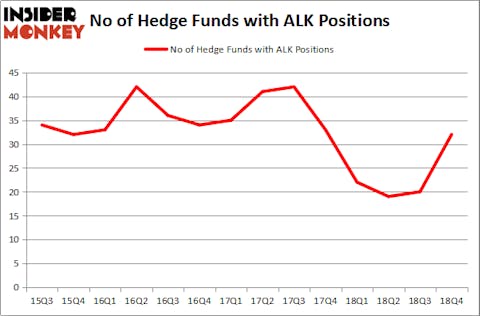

Alaska Air Group, Inc. (NYSE:ALK) was in 32 hedge funds’ portfolios at the end of the fourth quarter of 2018. ALK shareholders have witnessed an increase in support from the world’s most elite money managers lately. There were 20 hedge funds in our database with ALK positions at the end of the previous quarter. Our calculations also showed that ALK isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are perceived as underperforming, old investment vehicles of years past. While there are greater than 8000 funds with their doors open at the moment, Our experts look at the elite of this group, about 750 funds. These investment experts oversee the majority of the smart money’s total asset base, and by paying attention to their highest performing equity investments, Insider Monkey has spotted many investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a glance at the key hedge fund action surrounding Alaska Air Group, Inc. (NYSE:ALK).

What does the smart money think about Alaska Air Group, Inc. (NYSE:ALK)?

At the end of the fourth quarter, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from the previous quarter. By comparison, 22 hedge funds held shares or bullish call options in ALK a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, PAR Capital Management, managed by Paul Reeder and Edward Shapiro, holds the number one position in Alaska Air Group, Inc. (NYSE:ALK). PAR Capital Management has a $122.3 million position in the stock, comprising 2% of its 13F portfolio. Sitting at the No. 2 spot is Diamond Hill Capital, led by Ric Dillon, holding a $102.1 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism contain Ken Griffin’s Citadel Investment Group, D. E. Shaw’s D E Shaw and Steve Cohen’s Point72 Asset Management.

As aggregate interest increased, key hedge funds were breaking ground themselves. Columbus Circle Investors, managed by Principal Global Investors, initiated the biggest position in Alaska Air Group, Inc. (NYSE:ALK). Columbus Circle Investors had $16.9 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $14.1 million investment in the stock during the quarter. The other funds with brand new ALK positions are Jeffrey Talpins’s Element Capital Management, Joel Greenblatt’s Gotham Asset Management, and John Tompkins’s Tyvor Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Alaska Air Group, Inc. (NYSE:ALK) but similarly valued. We will take a look at Jazz Pharmaceuticals Public Limited Company (NASDAQ:JAZZ), Teledyne Technologies Incorporated (NYSE:TDY), Nutanix, Inc. (NASDAQ:NTNX), and China Southern Airlines Co Ltd (NYSE:ZNH). This group of stocks’ market valuations are similar to ALK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JAZZ | 31 | 597051 | 2 |

| TDY | 20 | 480161 | 1 |

| NTNX | 37 | 550381 | -2 |

| ZNH | 4 | 14176 | -1 |

| Average | 23 | 410442 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $410 million. That figure was $453 million in ALK’s case. Nutanix, Inc. (NASDAQ:NTNX) is the most popular stock in this table. On the other hand China Southern Airlines Co Ltd (NYSE:ZNH) is the least popular one with only 4 bullish hedge fund positions. Alaska Air Group, Inc. (NYSE:ALK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately ALK wasn’t in this group. Hedge funds that bet on ALK were disappointed as the stock lost 3.6% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.