Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

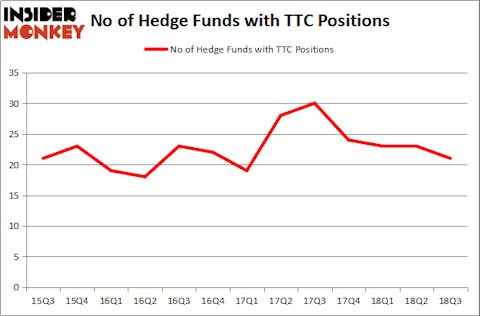

Is The Toro Company (NYSE:TTC) undervalued? The smart money is getting less optimistic. The number of long hedge fund bets decreased by 2 in recent months. Our calculations also showed that TTC isn’t among the 30 most popular stocks among hedge funds. TTC was in 21 hedge funds’ portfolios at the end of the third quarter of 2018. There were 23 hedge funds in our database with TTC holdings at the end of the previous quarter.

To most shareholders, hedge funds are assumed to be slow, outdated financial vehicles of years past. While there are over 8,000 funds with their doors open at the moment, Our experts hone in on the aristocrats of this group, approximately 700 funds. These investment experts handle the majority of the hedge fund industry’s total asset base, and by shadowing their best picks, Insider Monkey has deciphered a number of investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to review the new hedge fund action encompassing The Toro Company (NYSE:TTC).

What have hedge funds been doing with The Toro Company (NYSE:TTC)?

Heading into the fourth quarter of 2018, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TTC over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Select Equity Group, managed by Robert Joseph Caruso, holds the largest position in The Toro Company (NYSE:TTC). Select Equity Group has a $169.8 million position in the stock, comprising 1.3% of its 13F portfolio. The second most bullish fund manager is Fisher Asset Management, led by Ken Fisher, holding a $94.6 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish comprise Ian Simm’s Impax Asset Management, Cliff Asness’s AQR Capital Management and Noam Gottesman’s GLG Partners.

Because The Toro Company (NYSE:TTC) has faced bearish sentiment from the smart money, we can see that there lies a certain “tier” of fund managers who were dropping their positions entirely in the third quarter. It’s worth mentioning that Matthew Hulsizer’s PEAK6 Capital Management said goodbye to the largest stake of the 700 funds followed by Insider Monkey, totaling close to $1.3 million in stock, and Mike Vranos’s Ellington was right behind this move, as the fund dumped about $0.5 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to The Toro Company (NYSE:TTC). These stocks are Acuity Brands, Inc. (NYSE:AYI), Gildan Activewear Inc (NYSE:GIL), EQGP Holdings, LP (NYSE:EQGP), and CyrusOne Inc (NASDAQ:CONE). This group of stocks’ market valuations match TTC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AYI | 35 | 1284391 | 7 |

| GIL | 18 | 271699 | 3 |

| EQGP | 5 | 23037 | 1 |

| CONE | 24 | 224805 | 5 |

| Average | 20.5 | 450983 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $451 million. That figure was $499 million in TTC’s case. Acuity Brands, Inc. (NYSE:AYI) is the most popular stock in this table. On the other hand EQGP Holdings, LP (NYSE:EQGP) is the least popular one with only 5 bullish hedge fund positions. The Toro Company (NYSE:TTC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AYI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.