Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of The Liberty Braves Group (NASDAQ:BATRK).

Is The Liberty Braves Group (NASDAQ:BATRK) the right pick for your portfolio? Hedge funds are in a bearish mood. The number of long hedge fund positions went down by 1 in recent months. Our calculations also showed that BATRK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a lot of metrics shareholders have at their disposal to value stocks. A couple of the most under-the-radar metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outpace the S&P 500 by a very impressive amount (see the details here).

Mario Gabelli of GAMCO Investors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a glance at the new hedge fund action surrounding The Liberty Braves Group (NASDAQ:BATRK).

What have hedge funds been doing with The Liberty Braves Group (NASDAQ:BATRK)?

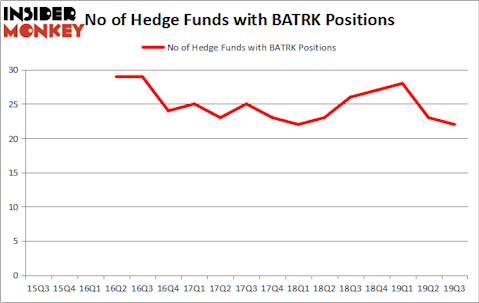

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in BATRK over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The Liberty Braves Group (NASDAQ:BATRK) was held by Park West Asset Management, which reported holding $74.5 million worth of stock at the end of September. It was followed by Tensile Capital with a $48.5 million position. Other investors bullish on the company included GAMCO Investors, Mason Capital Management, and Renaissance Technologies. In terms of the portfolio weights assigned to each position Lionstone Capital Management allocated the biggest weight to The Liberty Braves Group (NASDAQ:BATRK), around 9.51% of its 13F portfolio. Mason Capital Management is also relatively very bullish on the stock, setting aside 9.22 percent of its 13F equity portfolio to BATRK.

Judging by the fact that The Liberty Braves Group (NASDAQ:BATRK) has witnessed declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of fund managers that slashed their entire stakes last quarter. It’s worth mentioning that Howard Marks’s Oaktree Capital Management dropped the biggest stake of the “upper crust” of funds followed by Insider Monkey, comprising an estimated $5.1 million in stock, and Parvinder Thiara’s Athanor Capital was right behind this move, as the fund sold off about $2 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Liberty Braves Group (NASDAQ:BATRK) but similarly valued. These stocks are Linx S.A. (NYSE:LINX), State Auto Financial Corporation (NASDAQ:STFC), US Ecology Inc. (NASDAQ:ECOL), and Huron Consulting Group Inc. (NASDAQ:HURN). This group of stocks’ market valuations match BATRK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LINX | 5 | 35694 | -9 |

| STFC | 7 | 16867 | 0 |

| ECOL | 8 | 8206 | 3 |

| HURN | 11 | 43978 | 0 |

| Average | 7.75 | 26186 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $26 million. That figure was $318 million in BATRK’s case. Huron Consulting Group Inc. (NASDAQ:HURN) is the most popular stock in this table. On the other hand Linx S.A. (NYSE:LINX) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks The Liberty Braves Group (NASDAQ:BATRK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately BATRK wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BATRK were disappointed as the stock returned 2% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.