We can judge whether Patterson Companies, Inc. (NASDAQ:PDCO) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

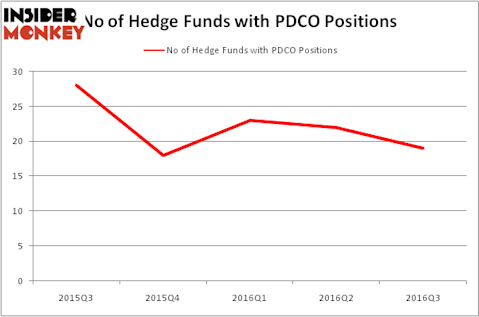

Patterson Companies, Inc. (NASDAQ:PDCO) was in 19 hedge funds’ portfolios at the end of the third quarter of 2016. PDCO investors should pay attention to a decrease in support from the world’s most successful money managers recently. There were 22 hedge funds in our database with PDCO positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Phillips 66 Partners LP (NYSE:PSXP), United Therapeutics Corporation (NASDAQ:UTHR), and Braskem SA (ADR) (NYSE:BAK) to gather more data points.

Follow Patterson Companies Inc. (NASDAQ:PDCO)

Follow Patterson Companies Inc. (NASDAQ:PDCO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

artefacti/Shutterstock.com

How are hedge funds trading Patterson Companies, Inc. (NASDAQ:PDCO)?

Heading into the fourth quarter of 2016, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a fall of 14% from the second quarter of 2016. By comparison, 18 hedge funds held shares or bullish call options in PDCO heading into this year. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, GAMCO Investors, led by Mario Gabelli, holds the largest position in Patterson Companies, Inc. (NASDAQ:PDCO). GAMCO Investors has a $67.1 million position in the stock. The second most bullish fund manager is James Dondero of Highland Capital Management, with a $26.9 million position. Some other hedge funds and institutional investors that hold long positions comprise Justin John Ferayorni’s Tamarack Capital Management, John D. Gillespie’s Prospector Partners and Greg Poole’s Echo Street Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.