In this article we will take a look at whether hedge funds think New Age Beverages Corporation (NASDAQ:NBEV) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

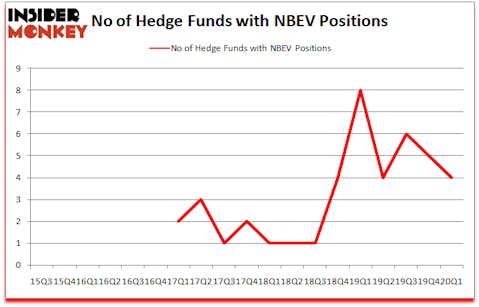

New Age Beverages Corporation (NASDAQ:NBEV) shareholders have witnessed a decrease in activity from the world’s largest hedge funds recently. NBEV was in 4 hedge funds’ portfolios at the end of March. There were 5 hedge funds in our database with NBEV holdings at the end of the previous quarter. Our calculations also showed that NBEV isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 51 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Now we’re going to take a gander at the fresh hedge fund action encompassing New Age Beverages Corporation (NASDAQ:NBEV).

How are hedge funds trading New Age Beverages Corporation (NASDAQ:NBEV)?

Heading into the second quarter of 2020, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NBEV over the last 18 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Citadel Investment Group, managed by Ken Griffin, holds the biggest position in New Age Beverages Corporation (NASDAQ:NBEV). Citadel Investment Group has a $0.3 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by OZ Management, led by Daniel S. Och, holding a $0.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism include Ken Griffin’s Citadel Investment Group, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to New Age Beverages Corporation (NASDAQ:NBEV), around 0.03% of its 13F portfolio. OZ Management is also relatively very bullish on the stock, designating 0.0035 percent of its 13F equity portfolio to NBEV.

Because New Age Beverages Corporation (NASDAQ:NBEV) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of funds that elected to cut their entire stakes heading into Q4. It’s worth mentioning that Michael Gelband’s ExodusPoint Capital said goodbye to the biggest position of all the hedgies watched by Insider Monkey, worth close to $0.3 million in stock, and Joel Greenblatt’s Gotham Asset Management was right behind this move, as the fund dropped about $0 million worth. These transactions are interesting, as total hedge fund interest dropped by 1 funds heading into Q4.

Let’s now review hedge fund activity in other stocks similar to New Age Beverages Corporation (NASDAQ:NBEV). We will take a look at Esquire Financial Holdings, Inc. (NASDAQ:ESQ), J.C. Penney Company, Inc. (NYSE:JCP), LogicBio Therapeutics, Inc. (NASDAQ:LOGC), and Mustang Bio, Inc. (NASDAQ:MBIO). This group of stocks’ market valuations are closest to NBEV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESQ | 4 | 9081 | -1 |

| JCP | 12 | 8075 | -3 |

| LOGC | 4 | 42883 | -1 |

| MBIO | 9 | 6461 | 1 |

| Average | 7.25 | 16625 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $1 million in NBEV’s case. J.C. Penney Company, Inc. (NYSE:JCP) is the most popular stock in this table. On the other hand Esquire Financial Holdings, Inc. (NASDAQ:ESQ) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks New Age Beverages Corporation (NASDAQ:NBEV) is even less popular than ESQ. Hedge funds dodged a bullet by taking a bearish stance towards NBEV. Our calculations showed that the top 10 most popular hedge fund stocks returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but managed to beat the market by 13.2 percentage points. Unfortunately NBEV wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was very bearish); NBEV investors were disappointed as the stock returned 8.6% during the second quarter (through the end of May) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Follow Newage Inc. (NASDAQ:NBEV)

Follow Newage Inc. (NASDAQ:NBEV)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.