We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Eagle Materials, Inc. (NYSE:EXP)? The smart money sentiment can provide an answer to this question.

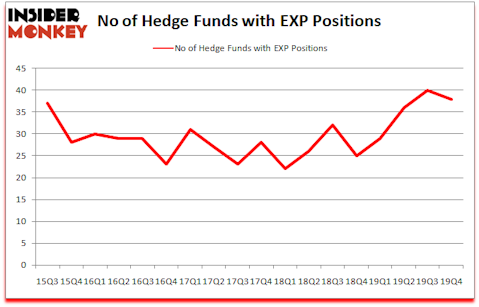

Eagle Materials, Inc. (NYSE:EXP) has seen a decrease in support from the world’s most elite money managers lately. Our calculations also showed that EXP isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

If you’d ask most shareholders, hedge funds are seen as slow, old financial vehicles of years past. While there are greater than 8000 funds with their doors open today, Our researchers hone in on the masters of this club, about 850 funds. Most estimates calculate that this group of people direct the majority of the hedge fund industry’s total asset base, and by watching their inimitable equity investments, Insider Monkey has discovered numerous investment strategies that have historically exceeded the market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Scott Ferguson of Sachem Head Capital

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s view the key hedge fund action surrounding Eagle Materials, Inc. (NYSE:EXP).

How have hedgies been trading Eagle Materials, Inc. (NYSE:EXP)?

At the end of the fourth quarter, a total of 38 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EXP over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Scott Ferguson’s Sachem Head Capital has the biggest position in Eagle Materials, Inc. (NYSE:EXP), worth close to $276.5 million, corresponding to 21.7% of its total 13F portfolio. On Sachem Head Capital’s heels is Empyrean Capital Partners, led by Michael A. Price and Amos Meron, holding a $50.8 million position; 3.3% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism encompass Richard Scott Greeder’s Broad Bay Capital, Renaissance Technologies and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Sachem Head Capital allocated the biggest weight to Eagle Materials, Inc. (NYSE:EXP), around 21.71% of its 13F portfolio. Broad Bay Capital is also relatively very bullish on the stock, dishing out 9.57 percent of its 13F equity portfolio to EXP.

Seeing as Eagle Materials, Inc. (NYSE:EXP) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few funds who sold off their full holdings heading into Q4. Interestingly, John Khoury’s Long Pond Capital sold off the largest position of the “upper crust” of funds monitored by Insider Monkey, comprising about $79.7 million in call options. Matthew Mark’s fund, Jet Capital Investors, also cut its call options, about $20.7 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 2 funds heading into Q4.

Let’s go over hedge fund activity in other stocks similar to Eagle Materials, Inc. (NYSE:EXP). We will take a look at Murphy USA Inc. (NYSE:MUSA), SLM Corp (NASDAQ:SLM), PBF Energy Inc (NYSE:PBF), and Yamana Gold Inc. (NYSE:AUY). This group of stocks’ market caps match EXP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MUSA | 28 | 330732 | 6 |

| SLM | 39 | 634486 | 10 |

| PBF | 32 | 279673 | 2 |

| AUY | 16 | 262811 | -5 |

| Average | 28.75 | 376926 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $377 million. That figure was $537 million in EXP’s case. SLM Corp (NASDAQ:SLM) is the most popular stock in this table. On the other hand Yamana Gold Inc. (NYSE:AUY) is the least popular one with only 16 bullish hedge fund positions. Eagle Materials, Inc. (NYSE:EXP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but beat the market by 5.5 percentage points. Unfortunately EXP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EXP were disappointed as the stock returned -41.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.