Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Denison Mines Corp (NYSE:DNN) changed recently.

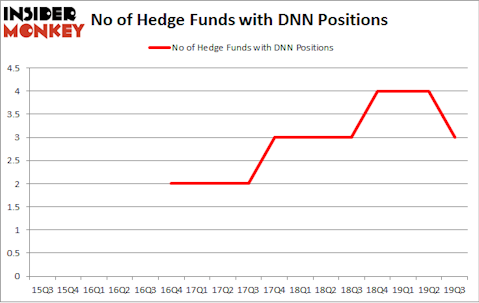

Denison Mines Corp (NYSE:DNN) investors should be aware of a decrease in hedge fund sentiment recently. Our calculations also showed that DNN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ken Griffin of Citadel Investment Group

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind we’re going to take a peek at the fresh hedge fund action surrounding Denison Mines Corp (NYSE:DNN).

What have hedge funds been doing with Denison Mines Corp (NYSE:DNN)?

At the end of the third quarter, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DNN over the last 17 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Denison Mines Corp (NYSE:DNN) was held by Falcon Edge Capital, which reported holding $1.4 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $0.1 million position. The only other hedge fund that is bullish on the company was Sprott Asset Management.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Renaissance Technologies. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified DNN as a viable investment and initiated a position in the stock.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Denison Mines Corp (NYSE:DNN) but similarly valued. These stocks are Scholar Rock Holding Corporation (NASDAQ:SRRK), Covia Holdings Corporation (NYSE:CVIA), Avid Technology, Inc. (NASDAQ:AVID), and Leju Holdings Limited (NYSE:LEJU). This group of stocks’ market values are similar to DNN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRRK | 7 | 29330 | -1 |

| CVIA | 8 | 15347 | 1 |

| AVID | 13 | 39069 | 0 |

| LEJU | 1 | 2529 | -1 |

| Average | 7.25 | 21569 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $1 million in DNN’s case. Avid Technology, Inc. (NASDAQ:AVID) is the most popular stock in this table. On the other hand Leju Holdings Limited (NYSE:LEJU) is the least popular one with only 1 bullish hedge fund positions. Denison Mines Corp (NYSE:DNN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately DNN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); DNN investors were disappointed as the stock returned -4.4% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.