After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Camden Property Trust (NYSE:CPT).

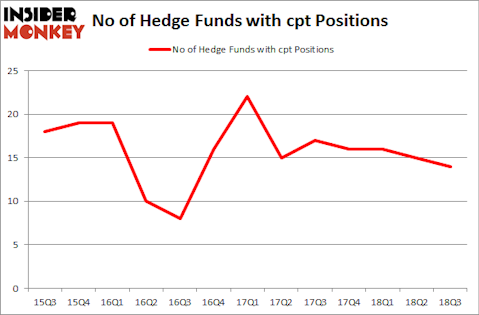

Camden Property Trust (NYSE:CPT) has experienced a decrease in hedge fund interest recently. Our calculations also showed that cpt isn’t among the 30 most popular stocks among hedge funds.

At the moment there are tons of signals market participants put to use to appraise their holdings. A duo of the most useful signals are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the top investment managers can outpace the broader indices by a very impressive amount (see the details here).

Cliff Asness of AQR Capital Management

We’re going to take a peek at the key hedge fund action regarding Camden Property Trust (NYSE:CPT).

How have hedgies been trading Camden Property Trust (NYSE:CPT)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in CPT heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Camden Property Trust (NYSE:CPT), with a stake worth $103.6 million reported as of the end of September. Trailing Citadel Investment Group was Millennium Management, which amassed a stake valued at $70.9 million. AEW Capital Management, Two Sigma Advisors, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Camden Property Trust (NYSE:CPT) has experienced declining sentiment from hedge fund managers, logic holds that there lies a certain “tier” of hedgies that decided to sell off their positions entirely last quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management cut the largest position of the 700 funds watched by Insider Monkey, worth an estimated $35.1 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund said goodbye to about $1.1 million worth. These moves are interesting, as total hedge fund interest dropped by 1 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Camden Property Trust (NYSE:CPT). We will take a look at RPM International Inc. (NYSE:RPM), Under Armour Inc (NYSE:UA), Grupo Aval Acciones y Valores S.A. (NYSE:AVAL), and WEX Inc (NYSE:WEX). This group of stocks’ market valuations match CPT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RPM | 28 | 491022 | 7 |

| UA | 28 | 700316 | 6 |

| AVAL | 6 | 18562 | 2 |

| WEX | 28 | 561491 | 0 |

| Average | 22.5 | 442848 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $443 million. That figure was $281 million in CPT’s case. RPM International Inc. (NYSE:RPM) is the most popular stock in this table. On the other hand Grupo Aval Acciones y Valores S.A. (NYSE:AVAL) is the least popular one with only 6 bullish hedge fund positions. Camden Property Trust (NYSE:CPT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RPM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.