Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards Cognyte Software Ltd. (NASDAQ:CGNT) to find out whether there were any major changes in hedge funds’ views.

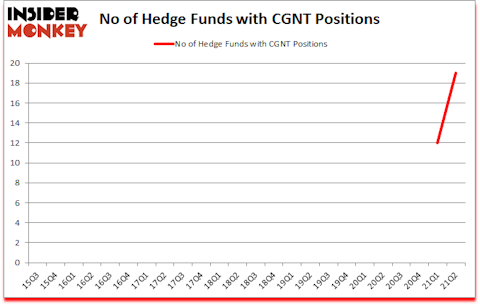

Cognyte Software Ltd. (NASDAQ:CGNT) shareholders have witnessed an increase in hedge fund interest in recent months. Cognyte Software Ltd. (NASDAQ:CGNT) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 12. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 12 hedge funds in our database with CGNT holdings at the end of March. Our calculations also showed that CGNT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

According to most investors, hedge funds are viewed as underperforming, old financial tools of years past. While there are more than 8000 funds in operation at the moment, We choose to focus on the masters of this club, around 850 funds. These hedge fund managers manage bulk of all hedge funds’ total capital, and by paying attention to their unrivaled equity investments, Insider Monkey has unsheathed a few investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Keeping this in mind we’re going to take a look at the latest hedge fund action encompassing Cognyte Software Ltd. (NASDAQ:CGNT).

Do Hedge Funds Think CGNT Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 58% from the first quarter of 2020. On the other hand, there were a total of 0 hedge funds with a bullish position in CGNT a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Richard Mashaal’s Rima Senvest Management has the most valuable position in Cognyte Software Ltd. (NASDAQ:CGNT), worth close to $83.5 million, accounting for 2.4% of its total 13F portfolio. On Rima Senvest Management’s heels is RGM Capital, led by Robert G. Moses, holding a $73.3 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Amy Minella’s Cardinal Capital, Anand Parekh’s Alyeska Investment Group and Steven Ng and Andrew Mitchell’s Ophir Asset Management. In terms of the portfolio weights assigned to each position Ophir Asset Management allocated the biggest weight to Cognyte Software Ltd. (NASDAQ:CGNT), around 5.65% of its 13F portfolio. RGM Capital is also relatively very bullish on the stock, setting aside 3.39 percent of its 13F equity portfolio to CGNT.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Cardinal Capital, managed by Amy Minella, established the most valuable position in Cognyte Software Ltd. (NASDAQ:CGNT). Cardinal Capital had $43.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $23.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group, and Renaissance Technologies.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Cognyte Software Ltd. (NASDAQ:CGNT) but similarly valued. We will take a look at Harsco Corporation (NYSE:HSC), Meta Financial Group Inc. (NASDAQ:CASH), Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL), MacroGenics Inc (NASDAQ:MGNX), Sixth Street Specialty Lending Inc (NYSE:TSLX), Northwest Natural Holding Company (NYSE:NWN), and Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY). This group of stocks’ market values are closest to CGNT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HSC | 11 | 47657 | 1 |

| CASH | 15 | 121640 | 1 |

| MDGL | 20 | 437926 | 3 |

| MGNX | 24 | 437546 | -6 |

| TSLX | 10 | 93984 | 1 |

| NWN | 11 | 14194 | 1 |

| HRMY | 15 | 173932 | 5 |

| Average | 15.1 | 189554 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.1 hedge funds with bullish positions and the average amount invested in these stocks was $190 million. That figure was $346 million in CGNT’s case. MacroGenics Inc (NASDAQ:MGNX) is the most popular stock in this table. On the other hand Sixth Street Specialty Lending Inc (NYSE:TSLX) is the least popular one with only 10 bullish hedge fund positions. Cognyte Software Ltd. (NASDAQ:CGNT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CGNT is 72.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and beat the market again by 1.6 percentage points. Unfortunately CGNT wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on CGNT were disappointed as the stock returned -8.8% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Cogentix Medical Inc (NASDAQ:CGNT)

Follow Cogentix Medical Inc (NASDAQ:CGNT)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Stocks Under $10 to Buy Right Now

- 10 Best Oil Stocks to Buy Amid Post-COVID Demand Boom and Price Volatility

- 15 Best News and Reading Apps

Disclosure: None. This article was originally published at Insider Monkey.