The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 873 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article we look at what those investors think of Wynn Resorts, Limited (NASDAQ:WYNN).

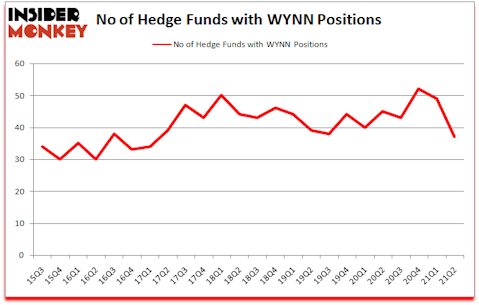

Wynn Resorts, Limited (NASDAQ:WYNN) has experienced a decrease in enthusiasm from smart money recently. Wynn Resorts, Limited (NASDAQ:WYNN) was in 37 hedge funds’ portfolios at the end of June. The all time high for this statistic is 52. There were 49 hedge funds in our database with WYNN holdings at the end of March. Our calculations also showed that WYNN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

If you’d ask most traders, hedge funds are seen as slow, outdated financial tools of yesteryear. While there are greater than 8000 funds with their doors open at present, We choose to focus on the bigwigs of this group, around 850 funds. It is estimated that this group of investors orchestrate the lion’s share of all hedge funds’ total asset base, and by monitoring their top picks, Insider Monkey has revealed many investment strategies that have historically outrun the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Gil Simon of SoMa Equity Partners

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, we like undervalued, EBITDA-positive growth stocks, so we are checking out stock pitches like this emerging biotech stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a gander at the latest hedge fund action encompassing Wynn Resorts, Limited (NASDAQ:WYNN).

Do Hedge Funds Think WYNN Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from the previous quarter. The graph below displays the number of hedge funds with bullish position in WYNN over the last 24 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, 0 held the most valuable stake in Wynn Resorts, Limited (NASDAQ:WYNN), which was worth $214 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $161 million worth of shares. Citadel Investment Group, Iridian Asset Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Rip Road Capital allocated the biggest weight to Wynn Resorts, Limited (NASDAQ:WYNN), around 6.26% of its 13F portfolio. Chescapmanager LLC is also relatively very bullish on the stock, dishing out 5.16 percent of its 13F equity portfolio to WYNN.

Since Wynn Resorts, Limited (NASDAQ:WYNN) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedgies that elected to cut their positions entirely in the second quarter. Intriguingly, Josh Resnick’s Jericho Capital Asset Management cut the largest investment of all the hedgies tracked by Insider Monkey, totaling an estimated $105.1 million in stock. Gabriel Plotkin’s fund, Melvin Capital Management, also said goodbye to its stock, about $78.4 million worth. These transactions are important to note, as total hedge fund interest dropped by 12 funds in the second quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Wynn Resorts, Limited (NASDAQ:WYNN) but similarly valued. These stocks are ABIOMED, Inc. (NASDAQ:ABMD), Oak Street Health, Inc. (NYSE:OSH), Aluminum Corp. of China Limited (NYSE:ACH), The J.M. Smucker Company (NYSE:SJM), Continental Resources, Inc. (NYSE:CLR), Alliant Energy Corporation (NASDAQ:LNT), and FMC Corporation (NYSE:FMC). This group of stocks’ market valuations resemble WYNN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ABMD | 24 | 899188 | -2 |

| OSH | 33 | 561397 | 2 |

| ACH | 4 | 8000 | 1 |

| SJM | 34 | 580514 | 1 |

| CLR | 23 | 172410 | 0 |

| LNT | 16 | 70771 | 3 |

| FMC | 33 | 372160 | 1 |

| Average | 23.9 | 380634 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.9 hedge funds with bullish positions and the average amount invested in these stocks was $381 million. That figure was $712 million in WYNN’s case. The J.M. Smucker Company (NYSE:SJM) is the most popular stock in this table. On the other hand Aluminum Corp. of China Limited (NYSE:ACH) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Wynn Resorts, Limited (NASDAQ:WYNN) is more popular among hedge funds. Our overall hedge fund sentiment score for WYNN is 64.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 21.8% in 2021 through October 11th and still beat the market by 4.4 percentage points. Unfortunately WYNN wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on WYNN were disappointed as the stock returned -27.2% since the end of the second quarter (through 10/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Wynn Resorts Ltd (NASDAQ:WYNN)

Follow Wynn Resorts Ltd (NASDAQ:WYNN)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Cheap Oil Stocks to Buy in 2021

- 10 Best Cryptocurrencies Redditors are Buying

- 10 Best Construction Materials Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.