Does Silk Road Medical, Inc. (NASDAQ:SILK) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

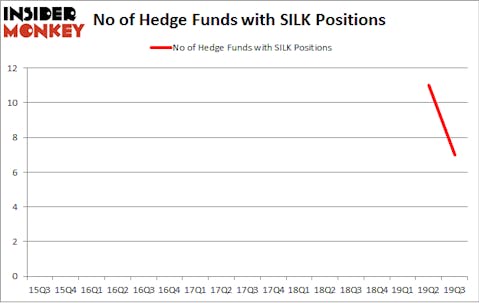

Is Silk Road Medical, Inc. (NASDAQ:SILK) a great investment now? The best stock pickers are taking a pessimistic view. The number of long hedge fund bets decreased by 4 recently. Our calculations also showed that SILK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Phill Gross of Adage Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the new hedge fund action surrounding Silk Road Medical, Inc. (NASDAQ:SILK).

What does smart money think about Silk Road Medical, Inc. (NASDAQ:SILK)?

At Q3’s end, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -36% from the second quarter of 2019. By comparison, 0 hedge funds held shares or bullish call options in SILK a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Deerfield Management was the largest shareholder of Silk Road Medical, Inc. (NASDAQ:SILK), with a stake worth $31.9 million reported as of the end of September. Trailing Deerfield Management was Great Point Partners, which amassed a stake valued at $9.8 million. Alyeska Investment Group, Adage Capital Management, and Zimmer Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Deerfield Management allocated the biggest weight to Silk Road Medical, Inc. (NASDAQ:SILK), around 1.3% of its 13F portfolio. Great Point Partners is also relatively very bullish on the stock, designating 0.9 percent of its 13F equity portfolio to SILK.

Due to the fact that Silk Road Medical, Inc. (NASDAQ:SILK) has witnessed falling interest from the smart money, logic holds that there was a specific group of fund managers that slashed their positions entirely by the end of the third quarter. It’s worth mentioning that Israel Englander’s Millennium Management cut the largest stake of the 750 funds followed by Insider Monkey, comprising close to $14 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund dropped about $3.6 million worth. These transactions are interesting, as total hedge fund interest was cut by 4 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Silk Road Medical, Inc. (NASDAQ:SILK). These stocks are Lindsay Corporation (NYSE:LNN), Meridian Bancorp, Inc. (NASDAQ:EBSB), Primoris Services Corporation (NASDAQ:PRIM), and Sandstorm Gold Ltd. (NYSE:SAND). This group of stocks’ market valuations are similar to SILK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LNN | 8 | 193429 | 2 |

| EBSB | 10 | 88413 | -1 |

| PRIM | 13 | 28390 | 1 |

| SAND | 14 | 66333 | -1 |

| Average | 11.25 | 94141 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $53 million in SILK’s case. Sandstorm Gold Ltd. (NYSE:SAND) is the most popular stock in this table. On the other hand Lindsay Corporation (NYSE:LNN) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Silk Road Medical, Inc. (NASDAQ:SILK) is even less popular than LNN. Hedge funds clearly dropped the ball on SILK as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on SILK as the stock returned 10.7% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.