Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Signet Jewelers Limited (NYSE:SIG) and see how the stock is affected by the recent hedge fund activity.

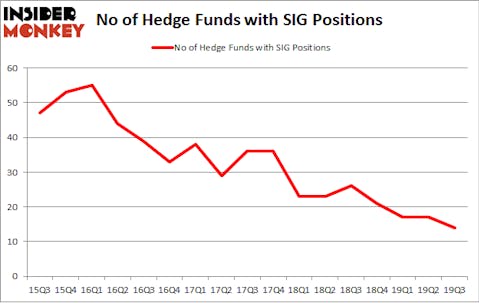

Signet Jewelers Limited (NYSE:SIG) investors should pay attention to a decrease in enthusiasm from smart money of late. SIG was in 14 hedge funds’ portfolios at the end of the third quarter of 2019. There were 17 hedge funds in our database with SIG holdings at the end of the previous quarter. Our calculations also showed that SIG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Lee Ainslie of Maverick Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s analyze the key hedge fund action regarding Signet Jewelers Limited (NYSE:SIG).

What does smart money think about Signet Jewelers Limited (NYSE:SIG)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SIG over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Signet Jewelers Limited (NYSE:SIG) was held by Select Equity Group, which reported holding $35.8 million worth of stock at the end of September. It was followed by AQR Capital Management with a $26.5 million position. Other investors bullish on the company included D E Shaw, Arrowstreet Capital, and Maverick Capital. In terms of the portfolio weights assigned to each position Quantinno Capital allocated the biggest weight to Signet Jewelers Limited (NYSE:SIG), around 0.37% of its 13F portfolio. Select Equity Group is also relatively very bullish on the stock, earmarking 0.24 percent of its 13F equity portfolio to SIG.

Due to the fact that Signet Jewelers Limited (NYSE:SIG) has witnessed falling interest from the smart money, it’s easy to see that there exists a select few hedge funds that elected to cut their entire stakes heading into Q4. At the top of the heap, Dmitry Balyasny’s Balyasny Asset Management said goodbye to the biggest stake of all the hedgies watched by Insider Monkey, totaling about $2.3 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also said goodbye to its stock, about $1.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 3 funds heading into Q4.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Signet Jewelers Limited (NYSE:SIG) but similarly valued. We will take a look at DHT Holdings Inc (NYSE:DHT), Federal Agricultural Mortgage Corporation (NYSE:AGM), Solar Capital Ltd. (NASDAQ:SLRC), and e.l.f. Beauty, Inc. (NYSE:ELF). This group of stocks’ market valuations match SIG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHT | 23 | 128089 | 7 |

| AGM | 10 | 32857 | 3 |

| SLRC | 13 | 52104 | 1 |

| ELF | 20 | 238245 | 2 |

| Average | 16.5 | 112824 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $113 million. That figure was $136 million in SIG’s case. DHT Holdings Inc (NYSE:DHT) is the most popular stock in this table. On the other hand Federal Agricultural Mortgage Corporation (NYSE:AGM) is the least popular one with only 10 bullish hedge fund positions. Signet Jewelers Limited (NYSE:SIG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on SIG as the stock returned 12.1% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.