Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first half of 2019. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Pearson PLC (NYSE:PSO) to find out whether it was one of their high conviction long-term ideas.

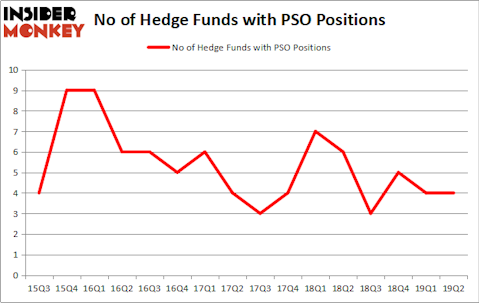

Pearson PLC (NYSE:PSO) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 4 hedge funds’ portfolios at the end of the second quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as News Corp (NASDAQ:NWS), Spirit AeroSystems Holdings, Inc. (NYSE:SPR), and Nielsen Holdings plc (NYSE:NLSN) to gather more data points. Our calculations also showed that PSO isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the fresh hedge fund action surrounding Pearson PLC (NYSE:PSO).

Hedge fund activity in Pearson PLC (NYSE:PSO)

Heading into the third quarter of 2019, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PSO over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies holds the biggest position in Pearson PLC (NYSE:PSO). Renaissance Technologies has a $4.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Renaissance Technologies’s heels is Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $2.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish encompass John Overdeck and David Siegel’s Two Sigma Advisors, and Michael Gelband’s ExodusPoint Capital.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Point72 Asset Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was ExodusPoint Capital).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Pearson PLC (NYSE:PSO) but similarly valued. We will take a look at News Corp (NASDAQ:NWS), Spirit AeroSystems Holdings, Inc. (NYSE:SPR), Nielsen Holdings plc (NYSE:NLSN), and Oaktree Capital Group LLC (NYSE:OAK). This group of stocks’ market valuations match PSO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NWS | 9 | 40127 | -1 |

| SPR | 31 | 2042908 | 2 |

| NLSN | 35 | 1457332 | 2 |

| OAK | 17 | 145509 | 2 |

| Average | 23 | 921469 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $921 million. That figure was $7 million in PSO’s case. Nielsen Holdings plc (NYSE:NLSN) is the most popular stock in this table. On the other hand News Corp (NASDAQ:NWS) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Pearson PLC (NYSE:PSO) is even less popular than NWS. Hedge funds dodged a bullet by taking a bearish stance towards PSO. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PSO wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); PSO investors were disappointed as the stock returned -12.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.