We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Livent Corporation (NYSE:LTHM).

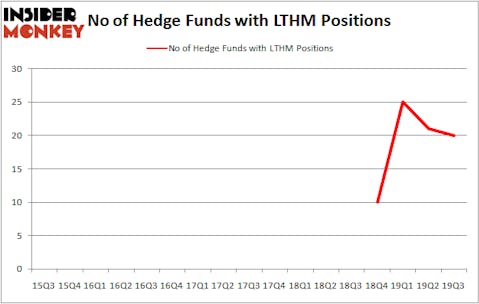

Is Livent Corporation (NYSE:LTHM) the right pick for your portfolio? Hedge funds are turning less bullish. The number of bullish hedge fund bets went down by 1 in recent months. Our calculations also showed that LTHM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). LTHM was in 20 hedge funds’ portfolios at the end of the third quarter of 2019. There were 21 hedge funds in our database with LTHM holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most market participants, hedge funds are perceived as unimportant, old financial vehicles of yesteryear. While there are over 8000 funds trading at present, Our researchers hone in on the masters of this club, approximately 750 funds. These investment experts manage the lion’s share of all hedge funds’ total capital, and by monitoring their highest performing investments, Insider Monkey has brought to light various investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Larry Robbins of Glenview Capital

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to review the new hedge fund action surrounding Livent Corporation (NYSE:LTHM).

How have hedgies been trading Livent Corporation (NYSE:LTHM)?

At Q3’s end, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the previous quarter. On the other hand, there were a total of 0 hedge funds with a bullish position in LTHM a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Luminus Management held the most valuable stake in Livent Corporation (NYSE:LTHM), which was worth $35.3 million at the end of the third quarter. On the second spot was Cardinal Capital which amassed $26.5 million worth of shares. Glenview Capital, Joho Capital, and York Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Joho Capital allocated the biggest weight to Livent Corporation (NYSE:LTHM), around 2.92% of its 13F portfolio. Luminus Management is also relatively very bullish on the stock, earmarking 1.02 percent of its 13F equity portfolio to LTHM.

Seeing as Livent Corporation (NYSE:LTHM) has witnessed a decline in interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of fund managers who were dropping their positions entirely heading into Q4. Intriguingly, Charles Paquelet’s Skylands Capital said goodbye to the biggest investment of all the hedgies monitored by Insider Monkey, worth an estimated $2.2 million in call options, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dumped about $2.1 million worth. These transactions are interesting, as total hedge fund interest was cut by 1 funds heading into Q4.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Livent Corporation (NYSE:LTHM) but similarly valued. We will take a look at National Western Life Group, Inc. (NASDAQ:NWLI), Zymeworks Inc. (NYSE:ZYME), Sculptor Capital Management, Inc. (NYSE:SCU), and Ferro Corporation (NYSE:FOE). This group of stocks’ market valuations are closest to LTHM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NWLI | 9 | 16662 | 1 |

| ZYME | 16 | 347944 | 2 |

| SCU | 11 | 65813 | 1 |

| FOE | 16 | 131293 | 2 |

| Average | 13 | 140428 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $124 million in LTHM’s case. Zymeworks Inc. (NYSE:ZYME) is the most popular stock in this table. On the other hand National Western Life Group, Inc. (NASDAQ:NWLI) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Livent Corporation (NYSE:LTHM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on LTHM as the stock returned 16.6% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.