We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of LaSalle Hotel Properties (NYSE:LHO) based on that data.

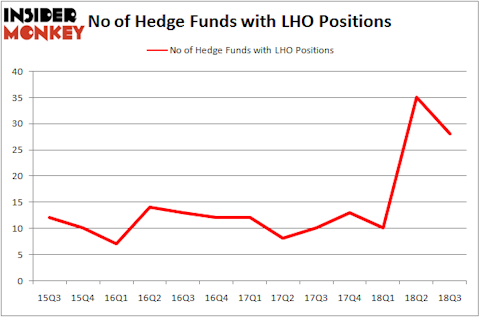

LaSalle Hotel Properties (NYSE:LHO) has experienced a decrease in support from the world’s most elite money managers of late. Our calculations also showed that LHO isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the new hedge fund action encompassing LaSalle Hotel Properties (NYSE:LHO).

What have hedge funds been doing with LaSalle Hotel Properties (NYSE:LHO)?

At Q3’s end, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from one quarter earlier. On the other hand, there were a total of 13 hedge funds with a bullish position in LHO at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, HG Vora Capital Management, managed by Parag Vora, holds the most valuable position in LaSalle Hotel Properties (NYSE:LHO). HG Vora Capital Management has a $173 million position in the stock, comprising 10.5% of its 13F portfolio. Coming in second is Long Pond Capital, managed by John Khoury, which holds a $83.4 million position; 2.2% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism comprise Carl Tiedemann and Michael Tiedemann’s TIG Advisors, John Bader’s Halcyon Asset Management and Alec Litowitz and Ross Laser’s Magnetar Capital.

Seeing as LaSalle Hotel Properties (NYSE:LHO) has experienced bearish sentiment from hedge fund managers, logic holds that there exists a select few funds who sold off their entire stakes last quarter. Intriguingly, Matthew Mark’s Jet Capital Investors sold off the largest investment of the “upper crust” of funds tracked by Insider Monkey, worth about $65 million in stock, and Simon Davies’s Sand Grove Capital Partners was right behind this move, as the fund sold off about $61.5 million worth. These transactions are interesting, as total hedge fund interest was cut by 7 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to LaSalle Hotel Properties (NYSE:LHO). These stocks are The New York Times Company (NYSE:NYT), Chemical Financial Corporation (NASDAQ:CHFC), Navistar International Corp (NYSE:NAV), and ViaSat, Inc. (NASDAQ:VSAT). This group of stocks’ market valuations are similar to LHO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NYT | 34 | 897710 | 6 |

| CHFC | 8 | 17870 | 4 |

| NAV | 26 | 1659346 | 4 |

| VSAT | 18 | 2031149 | 2 |

| Average | 21.5 | 1151519 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.15 billion. That figure was $744 million in LHO’s case. The New York Times Company (NYSE:NYT) is the most popular stock in this table. On the other hand Chemical Financial Corporation (NASDAQ:CHFC) is the least popular one with only 8 bullish hedge fund positions. LaSalle Hotel Properties (NYSE:LHO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NYT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.