“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second-worst May since the 1960s due to the escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards ExOne Co (NASDAQ:XONE) and see how it was affected.

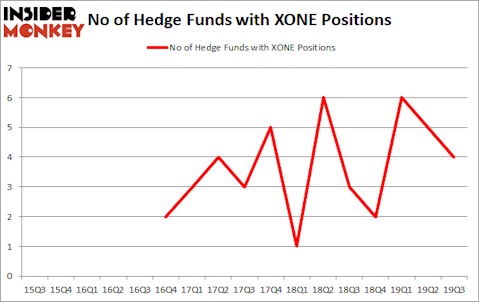

ExOne Co (NASDAQ:XONE) was in 4 hedge funds’ portfolios at the end of September. XONE has experienced a decrease in hedge fund sentiment lately. There were 5 hedge funds in our database with XONE holdings at the end of the previous quarter. Our calculations also showed that XONE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Israel Englander of Millennium Management

We leave no stone unturned when looking for the next great investment idea. For example, Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to take a peek at the latest hedge fund action surrounding ExOne Co (NASDAQ:XONE).

Hedge fund activity in ExOne Co (NASDAQ:XONE)

At Q3’s end, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from the second quarter of 2019. On the other hand, there were a total of 3 hedge funds with a bullish position in XONE a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by David E. Shaw, holds the most valuable position in ExOne Co (NASDAQ:XONE). D E Shaw has a $1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Minhua Zhang of Weld Capital Management, with a $0.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Ken Griffin’s Citadel Investment Group, Paul Tudor Jones’s Tudor Investment Corp and in terms of the portfolio weights assigned to each position Weld Capital Management allocated the biggest weight to ExOne Co (NASDAQ:XONE), around 0.04% of its 13F portfolio. Tudor Investment Corp is also relatively very bullish on the stock, setting aside 0.0034 percent of its 13F equity portfolio to XONE.

Judging by the fact that ExOne Co (NASDAQ:XONE) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there exist a select few hedge funds that elected to cut their positions entirely by the end of the third quarter. At the top of the heap, Jim Simons (founder)’s Renaissance Technologies dropped the biggest stake of all the hedgies monitored by Insider Monkey, comprising an estimated $0.5 million in stock. Israel Englander’s fund, Millennium Management, also said goodbye to its stock, about $0.3 million worth. These transactions are interesting, as total hedge fund interest was cut by 1 fund by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ExOne Co (NASDAQ:XONE) but similarly valued. These stocks are Pareteum Corporation (NASDAQ:TEUM), Aldeyra Therapeutics Inc (NASDAQ:ALDX), First Community Corporation (NASDAQ:FCCO), and Alithya Group inc. (NASDAQ:ALYA). This group of stocks’ market caps resembles XONE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TEUM | 5 | 3839 | 2 |

| ALDX | 12 | 46995 | -4 |

| FCCO | 3 | 8389 | -1 |

| ALYA | 5 | 15097 | -1 |

| Average | 6.25 | 18580 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $2 million in XONE’s case. Aldeyra Therapeutics Inc (NASDAQ:ALDX) is the most popular stock in this table. On the other hand, First Community Corporation (NASDAQ:FCCO) is the least popular one with only 3 bullish hedge fund positions. ExOne Co (NASDAQ:XONE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately, XONE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); XONE investors were disappointed as the stock returned -22.8% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large-cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.