It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 8 percentage points so far in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Zimmer Biomet Holdings Inc (NYSE:ZBH).

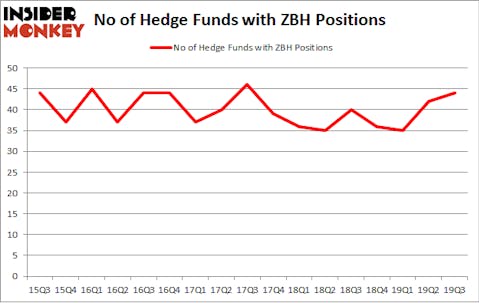

Is Zimmer Biomet Holdings Inc (NYSE:ZBH) the right investment to pursue these days? Money managers are in a bullish mood. The number of long hedge fund bets improved by 2 in recent months. Our calculations also showed that ZBH isn’t among the 30 most popular stocks among hedge funds. ZBH was in 44 hedge funds’ portfolios at the end of the third quarter of 2019. There were 42 hedge funds in our database with ZBH positions at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Barry Rosenstein of JANA Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the recent hedge fund action encompassing Zimmer Biomet Holdings Inc (NYSE:ZBH).

What have hedge funds been doing with Zimmer Biomet Holdings Inc (NYSE:ZBH)?

At the end of the third quarter, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ZBH over the last 17 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, Millennium Management held the most valuable stake in Zimmer Biomet Holdings Inc (NYSE:ZBH), which was worth $194 million at the end of the third quarter. On the second spot was Partner Fund Management which amassed $135.6 million worth of shares. Citadel Investment Group, JANA Partners, and Healthcor Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tavio Capital allocated the biggest weight to Zimmer Biomet Holdings Inc (NYSE:ZBH), around 20.64% of its portfolio. Prosight Capital is also relatively very bullish on the stock, earmarking 9.75 percent of its 13F equity portfolio to ZBH.

With a general bullishness amongst the heavyweights, some big names have jumped into Zimmer Biomet Holdings Inc (NYSE:ZBH) headfirst. Healthcor Management, managed by Arthur B Cohen and Joseph Healey, initiated the most outsized position in Zimmer Biomet Holdings Inc (NYSE:ZBH). Healthcor Management had $99.3 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $12 million investment in the stock during the quarter. The other funds with new positions in the stock are Ira Unschuld’s Brant Point Investment Management, Joseph Edelman’s Perceptive Advisors, and Ilan Assouline’s Circle Road Advisors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Zimmer Biomet Holdings Inc (NYSE:ZBH) but similarly valued. These stocks are Cintas Corporation (NASDAQ:CTAS), HP Inc. (NYSE:HPQ), PPG Industries, Inc. (NYSE:PPG), and Sirius XM Holdings Inc (NASDAQ:SIRI). All of these stocks’ market caps resemble ZBH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTAS | 37 | 931398 | 10 |

| HPQ | 38 | 2031394 | 6 |

| PPG | 27 | 421872 | 0 |

| SIRI | 33 | 1274312 | 4 |

| Average | 33.75 | 1164744 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.75 hedge funds with bullish positions and the average amount invested in these stocks was $1165 million. That figure was $1474 million in ZBH’s case. HP Inc. (NYSE:HPQ) is the most popular stock in this table. On the other hand PPG Industries, Inc. (NYSE:PPG) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Zimmer Biomet Holdings Inc (NYSE:ZBH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately ZBH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ZBH were disappointed as the stock returned 4.8% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.