Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about The Williams Companies, Inc. (NYSE:WMB) in this article.

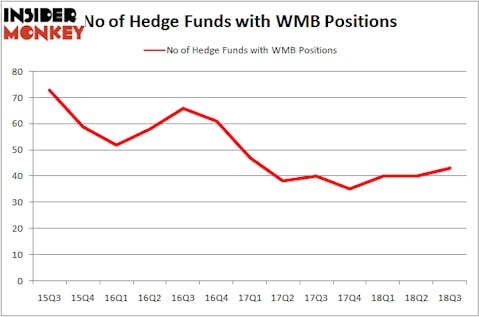

The Williams Companies, Inc. (NYSE:WMB) witnessed an increase in hedge fund sentiment in Q3, though it remains well removed from being one of the most popular energy stocks like it was three years ago, let alone one of the 30 Most Popular Stocks Among Hedge Funds. It did rank 4th on our list of the 20 Dividend Stocks That Billionaires Are Piling On, with the stock currently carrying a solid 5.56% dividend yield.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

What have hedge funds been doing with The Williams Companies, Inc. (NYSE:WMB)?

At the end of the third quarter, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WMB over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The Williams Companies, Inc. (NYSE:WMB) was held by King Street Capital, which reported holding $406.5 million worth of stock as of the end of September. It was followed by Glenview Capital with a $232.7 million position. Other investors bullish on the company included Steadfast Capital Management, Canyon Capital Advisors, and Millennium Management.

As aggregate interest increased, key money managers have been driving this bullishness. CQS Cayman LP, managed by Michael Hintze, initiated the most valuable position in The Williams Companies, Inc. (NYSE:WMB). CQS Cayman LP had $37.8 million invested in the company at the end of the quarter. David Tepper’s Appaloosa Management LP also initiated a $28.4 million position during the quarter. The following funds were also among the new WMB investors: T Boone Pickens’ BP Capital, Joel Greenblatt’s Gotham Asset Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Williams Companies, Inc. (NYSE:WMB) but similarly valued. We will take a look at eBay Inc (NASDAQ:EBAY), Spotify Technology S.A. (NYSE:SPOT), Johnson Controls International plc (NYSE:JCI), and Monster Beverage Corp (NASDAQ:MNST). This group of stocks’ market valuations are similar to WMB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBAY | 44 | 2276060 | -1 |

| SPOT | 67 | 5370943 | 14 |

| JCI | 16 | 513903 | 5 |

| MNST | 32 | 1209570 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $2.34 billion. That figure was $1.84 billion in WMB’s case. Spotify Technology S.A. (NYSE:SPOT) is the most popular stock in this table. On the other hand Johnson Controls International plc (NYSE:JCI) is the least popular one with only 16 bullish hedge fund positions. The Williams Companies, Inc. (NYSE:WMB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on, like Spotify.

Disclosure: None. This article was originally published at Insider Monkey.