The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Stryker Corporation (NYSE:SYK) and find out how it is affected by hedge funds’ moves.

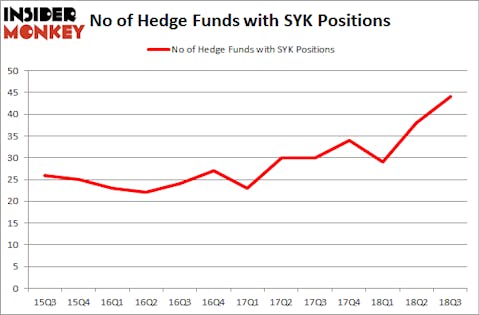

Is Stryker Corporation (NYSE:SYK) a healthy stock for your portfolio? Money managers are taking an optimistic view. The number of long hedge fund bets advanced by 6 in recent months. Our calculations also showed that SYK isn’t among the 30 most popular stocks among hedge funds. SYK was in 44 hedge funds’ portfolios at the end of the third quarter of 2018. There were 38 hedge funds in our database with SYK holdings at the end of the previous quarter.

In the eyes of most stock holders, hedge funds are viewed as worthless, outdated financial tools of the past. While there are over 8,000 funds in operation today, We look at the top tier of this group, approximately 700 funds. These money managers have their hands on the lion’s share of all hedge funds’ total capital, and by watching their finest picks, Insider Monkey has unearthed a number of investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Cliff Asness of AQR Capital Management

Let’s analyze the latest hedge fund action surrounding Stryker Corporation (NYSE:SYK).

What have hedge funds been doing with Stryker Corporation (NYSE:SYK)?

At Q3’s end, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of 16% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SYK over the last 13 quarters. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Stryker Corporation (NYSE:SYK), with a stake worth $161.8 million reported as of the end of September. Trailing Citadel Investment Group was Healthcor Management LP, which amassed a stake valued at $155.5 million. AQR Capital Management, Adage Capital Management, and Melvin Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers were leading the bulls’ herd. Melvin Capital Management, managed by Gabriel Plotkin, created the largest position in Stryker Corporation (NYSE:SYK). Melvin Capital Management had $48.9 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $26.4 million position during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Nick Thakore’s Diametric Capital, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Stryker Corporation (NYSE:SYK) but similarly valued. These stocks are Aetna Inc. (NYSE:AET), The Charles Schwab Corporation (NYSE:SCHW), Automatic Data Processing, Inc. (NASDAQ:ADP), and Banco Santander (Brasil) SA (NYSE:BSBR). All of these stocks’ market caps are closest to SYK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AET | 79 | 11792566 | 10 |

| SCHW | 53 | 3520233 | 13 |

| ADP | 35 | 3939324 | -7 |

| BSBR | 7 | 92574 | -4 |

| Average | 43.5 | 4836174 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43.5 hedge funds with bullish positions and the average amount invested in these stocks was $4.84 billion. That figure was $855 million in SYK’s case. Aetna Inc. (NYSE:AET) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 7 bullish hedge fund positions. Stryker Corporation (NYSE:SYK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AET might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.