The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Servicesource International Inc (NASDAQ:SREV), and what that likely means for the prospects of the company and its stock.

Is Servicesource International Inc (NASDAQ:SREV) worth your attention right now? Money managers are becoming more confident. The number of bullish hedge fund bets rose by 3 recently. Our calculations also showed that SREV isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the recent hedge fund action surrounding Servicesource International Inc (NASDAQ:SREV).

What does the smart money think about Servicesource International Inc (NASDAQ:SREV)?

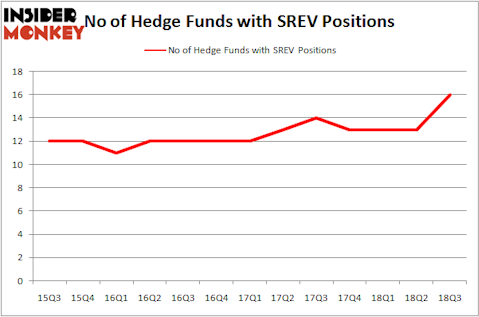

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 23% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in SREV over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, RGM Capital was the largest shareholder of Servicesource International Inc (NASDAQ:SREV), with a stake worth $19.2 million reported as of the end of September. Trailing RGM Capital was Harvest Capital Strategies, which amassed a stake valued at $17.1 million. Renaissance Technologies, Cannell Capital, and Prescott Group Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names were breaking ground themselves. Headlands Capital, managed by David Park, initiated the most outsized position in Servicesource International Inc (NASDAQ:SREV). Headlands Capital had $1.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $1.1 million position during the quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Servicesource International Inc (NASDAQ:SREV) but similarly valued. We will take a look at Civista Bancshares, Inc. (NASDAQ:CIVB), ACNB Corporation (NASDAQ:ACNB), Bel Fuse, Inc. (NASDAQ:BELFA), and Energous Corporation (NASDAQ:WATT). This group of stocks’ market values are closest to SREV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIVB | 9 | 34359 | 1 |

| ACNB | 1 | 2645 | 0 |

| BELFA | 4 | 8982 | 0 |

| WATT | 4 | 1115 | 1 |

| Average | 4.5 | 11775 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.5 hedge funds with bullish positions and the average amount invested in these stocks was $12 million. That figure was $73 million in SREV’s case. Civista Bancshares, Inc. (NASDAQ:CIVB) is the most popular stock in this table. On the other hand ACNB Corporation (NASDAQ:ACNB) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Servicesource International Inc (NASDAQ:SREV) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.