A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Retail Opportunity Investments Corp (NASDAQ:ROIC).

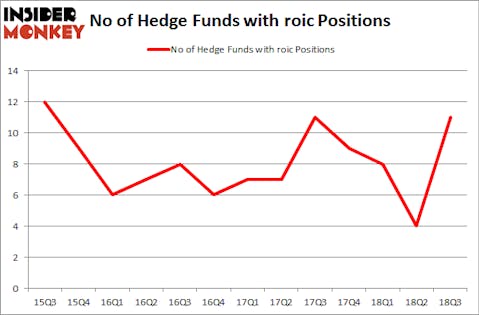

Is Retail Opportunity Investments Corp (NASDAQ:ROIC) undervalued? The best stock pickers are becoming hopeful. The number of long hedge fund bets moved up by 7 in recent months. Our calculations also showed that roic isn’t among the 30 most popular stocks among hedge funds. ROIC was in 11 hedge funds’ portfolios at the end of September. There were 4 hedge funds in our database with ROIC positions at the end of the previous quarter.

To the average investor there are many tools market participants employ to grade their holdings. Some of the most innovative tools are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the best money managers can beat the market by a superb margin (see the details here).

We’re going to take a peek at the fresh hedge fund action encompassing Retail Opportunity Investments Corp (NASDAQ:ROIC).

What have hedge funds been doing with Retail Opportunity Investments Corp (NASDAQ:ROIC)?

Heading into the fourth quarter of 2018, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 175% from the second quarter of 2018. By comparison, 9 hedge funds held shares or bullish call options in ROIC heading into this year. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Two Sigma Advisors was the largest shareholder of Retail Opportunity Investments Corp (NASDAQ:ROIC), with a stake worth $4.2 million reported as of the end of September. Trailing Two Sigma Advisors was Millennium Management, which amassed a stake valued at $3.5 million. D E Shaw, Point72 Asset Management, and Forward Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, assembled the largest position in Retail Opportunity Investments Corp (NASDAQ:ROIC). Millennium Management had $3.5 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $2.4 million investment in the stock during the quarter. The following funds were also among the new ROIC investors: Steve Cohen’s Point72 Asset Management, Jim Simons’s Renaissance Technologies, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks similar to Retail Opportunity Investments Corp (NASDAQ:ROIC). We will take a look at STAAR Surgical Company (NASDAQ:STAA), The Children’s Place Inc. (NASDAQ:PLCE), CNOOC Limited (NYSE:CEO), and Comfort Systems USA, Inc. (NYSE:FIX). All of these stocks’ market caps are closest to ROIC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STAA | 24 | 853639 | 9 |

| PLCE | 23 | 390120 | -2 |

| CEO | 15 | 365182 | 2 |

| FIX | 22 | 207509 | 2 |

| Average | 21 | 454113 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $454 million. That figure was $15 million in ROIC’s case. STAAR Surgical Company (NASDAQ:STAA) is the most popular stock in this table. On the other hand CNOOC Limited (NYSE:CEO) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Retail Opportunity Investments Corp (NASDAQ:ROIC) is even less popular than CEO. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.