We can judge whether PepsiCo, Inc. (NASDAQ:PEP) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

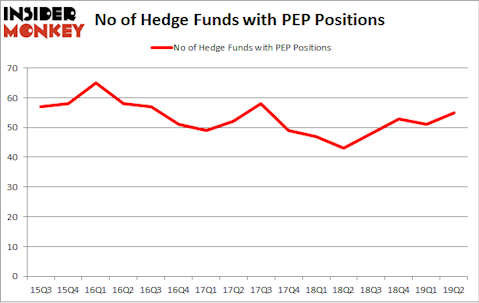

Is PepsiCo, Inc. (NASDAQ:PEP) ready to rally soon? Money managers are taking an optimistic view. The number of bullish hedge fund positions moved up by 4 lately. Our calculations also showed that PEP isn’t among the 30 most popular stocks among hedge funds. PEP was in 55 hedge funds’ portfolios at the end of June. There were 51 hedge funds in our database with PEP positions at the end of the previous quarter.

In the 21st century investor’s toolkit there are a multitude of signals market participants can use to size up their stock investments. A couple of the most under-the-radar signals are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outperform the broader indices by a superb margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the new hedge fund action regarding PepsiCo, Inc. (NASDAQ:PEP).

How are hedge funds trading PepsiCo, Inc. (NASDAQ:PEP)?

At Q2’s end, a total of 55 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. On the other hand, there were a total of 43 hedge funds with a bullish position in PEP a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Yacktman Asset Management, managed by Donald Yacktman, holds the number one position in PepsiCo, Inc. (NASDAQ:PEP). Yacktman Asset Management has a $876.2 million position in the stock, comprising 10.5% of its 13F portfolio. On Yacktman Asset Management’s heels is Renaissance Technologies, founded by Jim Simons, holding a $773.7 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish include Cliff Asness’s AQR Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors and D. E. Shaw’s D E Shaw.

As industrywide interest jumped, some big names have been driving this bullishness. Laurion Capital Management, managed by Benjamin A. Smith, initiated the most valuable call position in PepsiCo, Inc. (NASDAQ:PEP). Laurion Capital Management had $38 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $14.1 million position during the quarter. The other funds with new positions in the stock are Richard Chilton’s Chilton Investment Company, Perella Weinberg Partners, and Lee Ainslie’s Maverick Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as PepsiCo, Inc. (NASDAQ:PEP) but similarly valued. These stocks are Toyota Motor Corporation (NYSE:TM), Anheuser-Busch InBev SA/NV (NYSE:BUD), HSBC Holdings plc (NYSE:HSBC), and SAP SE (NYSE:SAP). This group of stocks’ market valuations are closest to PEP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TM | 8 | 193342 | -2 |

| BUD | 18 | 1763569 | -4 |

| HSBC | 16 | 1133528 | 4 |

| SAP | 17 | 1479359 | 9 |

| Average | 14.75 | 1142450 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $1142 million. That figure was $3618 million in PEP’s case. Anheuser-Busch InBev SA/NV (NYSE:BUD) is the most popular stock in this table. On the other hand Toyota Motor Corporation (NYSE:TM) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks PepsiCo, Inc. (NASDAQ:PEP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on PEP, though not to the same extent, as the stock returned 5.3% during the third quarter and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.