Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Marinus Pharmaceuticals Inc (NASDAQ:MRNS) to find out whether it was one of their high conviction long-term ideas.

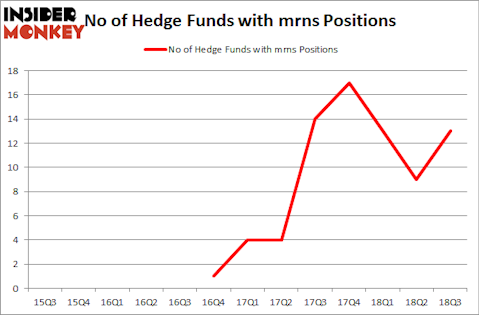

Marinus Pharmaceuticals Inc (NASDAQ:MRNS) was in 13 hedge funds’ portfolios at the end of September. MRNS has seen an increase in hedge fund interest in recent months. There were 9 hedge funds in our database with MRNS holdings at the end of the previous quarter. Our calculations also showed that mrns isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action regarding Marinus Pharmaceuticals Inc (NASDAQ:MRNS).

How are hedge funds trading Marinus Pharmaceuticals Inc (NASDAQ:MRNS)?

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 44% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MRNS over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Matthew Sidman’s Three Bays Capital has the most valuable position in Marinus Pharmaceuticals Inc (NASDAQ:MRNS), worth close to $19.1 million, comprising 2.2% of its total 13F portfolio. Sitting at the No. 2 spot is Partner Fund Management, led by Christopher James, holding a $17.7 million position; 0.3% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish encompass Ari Zweiman’s 683 Capital Partners, Warren Lammert’s Granite Point Capital and Joseph Edelman’s Perceptive Advisors.

As one would reasonably expect, specific money managers have jumped into Marinus Pharmaceuticals Inc (NASDAQ:MRNS) headfirst. Partner Fund Management, managed by Christopher James, established the biggest position in Marinus Pharmaceuticals Inc (NASDAQ:MRNS). Partner Fund Management had $17.7 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $2.1 million investment in the stock during the quarter. The other funds with brand new MRNS positions are Steve Cohen’s Point72 Asset Management and Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Marinus Pharmaceuticals Inc (NASDAQ:MRNS). We will take a look at MidWestOne Financial Group, Inc. (NASDAQ:MOFG), RBB Bancorp (NASDAQ:RBB), Royce Micro-Cap Trust, Inc. (NYSE:RMT), and CASI Pharmaceuticals Inc (NASDAQ:CASI). This group of stocks’ market values are closest to MRNS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MOFG | 5 | 35948 | -1 |

| RBB | 5 | 7234 | 1 |

| RMT | 4 | 25989 | 1 |

| CASI | 5 | 1373 | 0 |

| Average | 4.75 | 17636 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $83 million in MRNS’s case. MidWestOne Financial Group, Inc. (NASDAQ:MOFG) is the most popular stock in this table. On the other hand Royce Micro-Cap Trust, Inc. (NYSE:RMT) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Marinus Pharmaceuticals Inc (NASDAQ:MRNS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.