Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

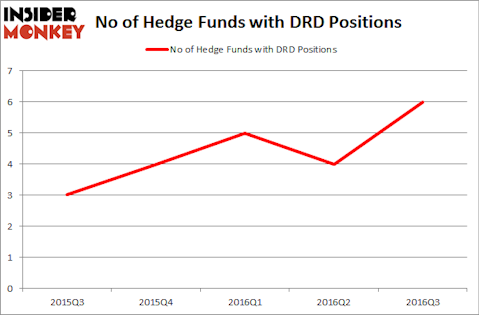

DRDGOLD Ltd. (ADR) (NYSE:DRD) was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. DRD has seen an increase in hedge fund sentiment lately. There were 4 hedge funds in our database with DRD positions at the end of the previous quarter. At the end of this article we will also compare DRD to other stocks including Lee Enterprises, Incorporated (NYSE:LEE), Pfenex Inc (NYSEMKT:PFNX), and EndoChoice Holdings Inc (NYSE:GI) to get a better sense of its popularity.

Follow Drdgold Ltd

Follow Drdgold Ltd

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Jeroen van den Broek/Shutterstock.com

With all of this in mind, we’re going to check out the recent action surrounding DRDGOLD Ltd. (ADR) (NYSE:DRD).

How have hedgies been trading DRDGOLD Ltd. (ADR) (NYSE:DRD)?

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards DRD over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world, has the biggest position in DRDGOLD Ltd. (ADR) (NYSE:DRD), worth close to $7.6 million, comprising less than 0.1%% of its total 13F portfolio. On Renaissance Technologies’ heels is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $3.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish include Israel Englander’s Millennium Management, Louis Navellier’s Navellier & Associates and Michael Platt and William Reeves’ BlueCrest Capital Mgmt.. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, key hedge funds have jumped into DRDGOLD Ltd. (ADR) (NYSE:DRD) headfirst. Millennium Management assembled the most valuable position in DRDGOLD Ltd. (ADR) (NYSE:DRD). Millennium Management had $0.9 million invested in the company at the end of the quarter. BlueCrest Capital Mgmt. also made a $0.1 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as DRDGOLD Ltd. (ADR) (NYSE:DRD) but similarly valued. These stocks are Lee Enterprises, Incorporated (NYSE:LEE), Pfenex Inc (NYSEMKT:PFNX), EndoChoice Holdings Inc (NYSE:GI), and Comtech Telecomm. Corp. (NASDAQ:CMTL). This group of stocks’ market valuations are closest to DRD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LEE | 10 | 8969 | 1 |

| PFNX | 8 | 18999 | -1 |

| GI | 8 | 11746 | 1 |

| CMTL | 11 | 42520 | -6 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $21 million. That figure was $13 million in DRD’s case. Comtech Telecomm. Corp. (NASDAQ:CMTL) is the most popular stock in this table. On the other hand Pfenex Inc (NYSEMKT:PFNX) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks DRDGOLD Ltd. (ADR) (NYSE:DRD) is even less popular than PFNX. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Countries With The Highest Rates of Serial Killers

Most Racist European Countries Towards Muslims

Most Open Minded Countries In The World

Disclosure: None