Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the third quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards American Campus Communities, Inc. (NYSE:ACC).

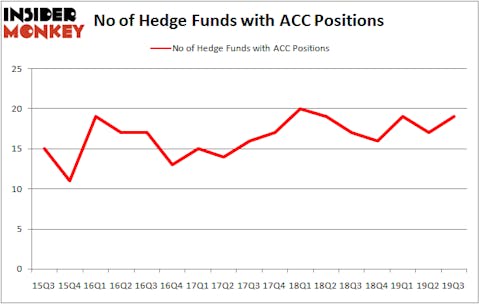

American Campus Communities, Inc. (NYSE:ACC) shareholders have witnessed an increase in hedge fund sentiment in recent months. ACC was in 19 hedge funds’ portfolios at the end of the third quarter of 2019. There were 17 hedge funds in our database with ACC holdings at the end of the previous quarter. Our calculations also showed that ACC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of metrics stock market investors employ to evaluate their holdings. A pair of the most under-the-radar metrics are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can beat the market by a significant margin (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s check out the recent hedge fund action surrounding American Campus Communities, Inc. (NYSE:ACC).

How are hedge funds trading American Campus Communities, Inc. (NYSE:ACC)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ACC over the last 17 quarters. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Among these funds, Diamond Hill Capital held the most valuable stake in American Campus Communities, Inc. (NYSE:ACC), which was worth $95.5 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $94.6 million worth of shares. Millennium Management, Winton Capital Management, and Balyasny Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sabrepoint Capital allocated the biggest weight to American Campus Communities, Inc. (NYSE:ACC), around 1.93% of its 13F portfolio. Winton Capital Management is also relatively very bullish on the stock, setting aside 0.6 percent of its 13F equity portfolio to ACC.

Consequently, specific money managers have been driving this bullishness. Sabrepoint Capital, managed by George Baxter, established the most valuable position in American Campus Communities, Inc. (NYSE:ACC). Sabrepoint Capital had $4.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $3.2 million position during the quarter. The following funds were also among the new ACC investors: Benjamin A. Smith’s Laurion Capital Management, Michael Gelband’s ExodusPoint Capital, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks similar to American Campus Communities, Inc. (NYSE:ACC). We will take a look at XPO Logistics Inc (NYSE:XPO), Dunkin Brands Group Inc (NASDAQ:DNKN), GCI Liberty, Inc. (NASDAQ:GLIBA), and Columbia Sportswear Company (NASDAQ:COLM). All of these stocks’ market caps are similar to ACC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XPO | 23 | 2709456 | -1 |

| DNKN | 24 | 193861 | 1 |

| GLIBA | 34 | 2003406 | -4 |

| COLM | 26 | 155276 | -1 |

| Average | 26.75 | 1265500 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $1265 million. That figure was $408 million in ACC’s case. GCI Liberty, Inc. (NASDAQ:GLIBA) is the most popular stock in this table. On the other hand XPO Logistics Inc (NYSE:XPO) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks American Campus Communities, Inc. (NYSE:ACC) is even less popular than XPO. Hedge funds dodged a bullet by taking a bearish stance towards ACC. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ACC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ACC investors were disappointed as the stock returned 0.9% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.