At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards V.F. Corporation (NYSE:VFC) at the end of the second quarter and determine whether the smart money was really smart about this stock.

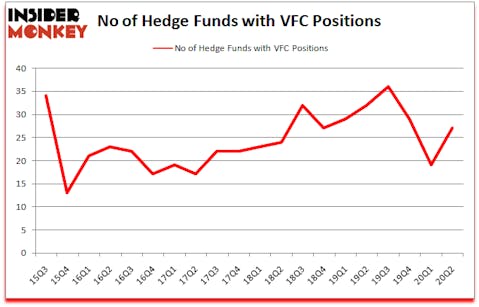

V.F. Corporation (NYSE:VFC) has seen an increase in hedge fund sentiment lately. V.F. Corporation (NYSE:VFC) was in 27 hedge funds’ portfolios at the end of June. The all time high for this statistics is 36. There were 19 hedge funds in our database with VFC holdings at the end of March. Our calculations also showed that VFC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are several metrics market participants can use to analyze publicly traded companies. A couple of the most underrated metrics are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite investment managers can trounce their index-focused peers by a solid margin (see the details here).

Ric Dillon of Diamond Hill Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind we’re going to check out the new hedge fund action encompassing V.F. Corporation (NYSE:VFC).

How are hedge funds trading V.F. Corporation (NYSE:VFC)?

At the end of the second quarter, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in VFC over the last 20 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in V.F. Corporation (NYSE:VFC) was held by Diamond Hill Capital, which reported holding $257.1 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $117.4 million position. Other investors bullish on the company included Citadel Investment Group, Renaissance Technologies, and Alyeska Investment Group. In terms of the portfolio weights assigned to each position Diamond Hill Capital allocated the biggest weight to V.F. Corporation (NYSE:VFC), around 1.52% of its 13F portfolio. Quantamental Technologies is also relatively very bullish on the stock, earmarking 0.66 percent of its 13F equity portfolio to VFC.

As industrywide interest jumped, some big names have been driving this bullishness. Renaissance Technologies, created the most valuable position in V.F. Corporation (NYSE:VFC). Renaissance Technologies had $29.9 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $26.8 million position during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Jack Woodruff’s Candlestick Capital Management, and Lee Ainslie’s Maverick Capital.

Let’s go over hedge fund activity in other stocks similar to V.F. Corporation (NYSE:VFC). We will take a look at Parker-Hannifin Corporation (NYSE:PH), Twitter Inc (NYSE:TWTR), Marvell Technology Group Ltd. (NASDAQ:MRVL), American Water Works Company, Inc. (NYSE:AWK), XP Inc. (NASDAQ:XP), The Williams Companies, Inc. (NYSE:WMB), and Ecopetrol S.A. (NYSE:EC). This group of stocks’ market values resemble VFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PH | 39 | 1172205 | 7 |

| TWTR | 68 | 1278023 | 13 |

| MRVL | 41 | 664690 | 12 |

| AWK | 30 | 653000 | 0 |

| XP | 21 | 430821 | 8 |

| WMB | 41 | 466723 | -6 |

| EC | 11 | 113508 | -1 |

| Average | 35.9 | 682710 | 4.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.9 hedge funds with bullish positions and the average amount invested in these stocks was $683 million. That figure was $559 million in VFC’s case. Twitter Inc (NYSE:TWTR) is the most popular stock in this table. On the other hand Ecopetrol S.A. (NYSE:EC) is the least popular one with only 11 bullish hedge fund positions. V.F. Corporation (NYSE:VFC) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for VFC is 46.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 21.3% in 2020 through September 25th and still beat the market by 17.7 percentage points. A small number of hedge funds were also right about betting on VFC as the stock returned 16.6% since the end of June (through September 25th) and outperformed the market by an even larger margin.

Follow V F Corp (NYSE:VFC)

Follow V F Corp (NYSE:VFC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.