How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding PTC Therapeutics, Inc. (NASDAQ:PTCT).

PTC Therapeutics, Inc. (NASDAQ:PTCT) investors should pay attention to an increase in support from the world’s most elite money managers lately. Our calculations also showed that PTCT isn’t among the 30 most popular stocks among hedge funds.

At the moment there are numerous metrics investors employ to value stocks. A pair of the most underrated metrics are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the best investment managers can beat the S&P 500 by a solid margin (see the details here).

Let’s take a gander at the latest hedge fund action regarding PTC Therapeutics, Inc. (NASDAQ:PTCT).

How are hedge funds trading PTC Therapeutics, Inc. (NASDAQ:PTCT)?

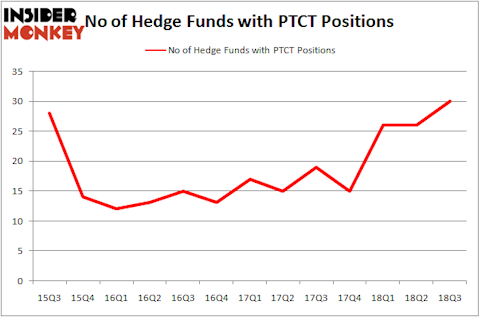

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PTCT over the last 13 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, D E Shaw was the largest shareholder of PTC Therapeutics, Inc. (NASDAQ:PTCT), with a stake worth $82.6 million reported as of the end of September. Trailing D E Shaw was Scopia Capital, which amassed a stake valued at $76 million. OrbiMed Advisors, Great Point Partners, and Balyasny Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds have been driving this bullishness. OrbiMed Advisors, managed by Samuel Isaly, assembled the most valuable position in PTC Therapeutics, Inc. (NASDAQ:PTCT). OrbiMed Advisors had $59.9 million invested in the company at the end of the quarter. Farallon Capital also initiated a $19.7 million position during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, Steve Cohen’s Point72 Asset Management, and Phill Gross and Robert Atchinson’s Adage Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as PTC Therapeutics, Inc. (NASDAQ:PTCT) but similarly valued. We will take a look at Sanderson Farms, Inc. (NASDAQ:SAFM), Yamana Gold Inc. (NYSE:AUY), Anixter International Inc. (NYSE:AXE), and California Resources Corporation (NYSE:CRC). This group of stocks’ market values resemble PTCT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAFM | 15 | 383627 | 0 |

| AUY | 18 | 84065 | 4 |

| AXE | 17 | 318658 | 2 |

| CRC | 22 | 414123 | -1 |

| Average | 18 | 300118 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $300 million. That figure was $497 million in PTCT’s case. California Resources Corporation (NYSE:CRC) is the most popular stock in this table. On the other hand Sanderson Farms, Inc. (NASDAQ:SAFM) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks PTC Therapeutics, Inc. (NASDAQ:PTCT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.