Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Maxim Integrated Products Inc. (NASDAQ:MXIM).

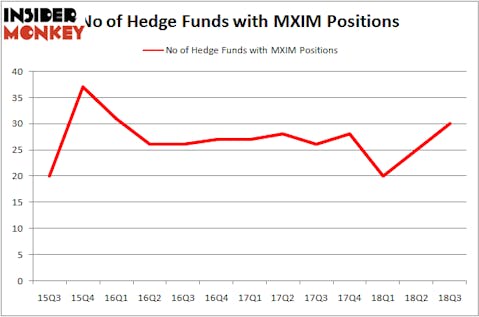

Maxim Integrated Products Inc. (NASDAQ:MXIM) was in 30 hedge funds’ portfolios at the end of the third quarter of 2018. MXIM investors should pay attention to an increase in hedge fund interest in recent months. There were 25 hedge funds in our database with MXIM holdings at the end of the previous quarter. Our calculations also showed that MXIM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action regarding Maxim Integrated Products Inc. (NASDAQ:MXIM).

How are hedge funds trading Maxim Integrated Products Inc. (NASDAQ:MXIM)?

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the previous quarter. By comparison, 28 hedge funds held shares or bullish call options in MXIM heading into this year. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Maxim Integrated Products Inc. (NASDAQ:MXIM) was held by Two Sigma Advisors, which reported holding $104.4 million worth of stock at the end of September. It was followed by AQR Capital Management with a $89.7 million position. Other investors bullish on the company included Renaissance Technologies, Millennium Management, and D E Shaw.

As industrywide interest jumped, key hedge funds were breaking ground themselves. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, created the largest position in Maxim Integrated Products Inc. (NASDAQ:MXIM). LMR Partners had $37.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $9.6 million position during the quarter. The other funds with new positions in the stock are Ray Dalio’s Bridgewater Associates, Matthew Tewksbury’s Stevens Capital Management, and Bruce Kovner’s Caxton Associates LP.

Let’s now review hedge fund activity in other stocks similar to Maxim Integrated Products Inc. (NASDAQ:MXIM). We will take a look at Host Hotels and Resorts Inc (NYSE:HST), First Republic Bank (NYSE:FRC), Fortinet Inc (NASDAQ:FTNT), and Shopify Inc (NYSE:SHOP). This group of stocks’ market values are similar to MXIM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HST | 21 | 383143 | 0 |

| FRC | 23 | 724485 | 6 |

| FTNT | 28 | 1046841 | 2 |

| SHOP | 28 | 1260759 | 3 |

| Average | 25 | 853807 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $854 million. That figure was $579 million in MXIM’s case. Fortinet Inc (NASDAQ:FTNT) is the most popular stock in this table. On the other hand Host Hotels and Resorts Inc (NYSE:HST) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Maxim Integrated Products Inc. (NASDAQ:MXIM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.