Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves.

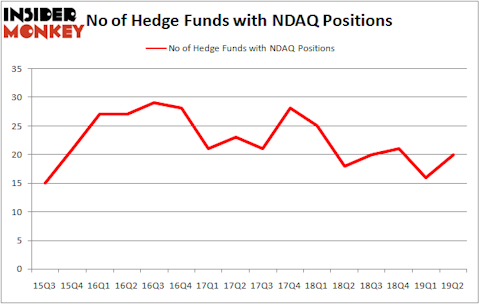

Nasdaq, Inc. (NASDAQ:NDAQ) has experienced an increase in hedge fund interest lately. Our calculations also showed that NDAQ isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the new hedge fund action encompassing Nasdaq, Inc. (NASDAQ:NDAQ).

What does smart money think about Nasdaq, Inc. (NASDAQ:NDAQ)?

Heading into the third quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in NDAQ a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Nasdaq, Inc. (NASDAQ:NDAQ) was held by D E Shaw, which reported holding $33.7 million worth of stock at the end of March. It was followed by Carlson Capital with a $21.5 million position. Other investors bullish on the company included Adage Capital Management, Sloane Robinson Investment Management, and Marshall Wace LLP.

Consequently, key hedge funds were leading the bulls’ herd. Carlson Capital, managed by Clint Carlson, established the most valuable position in Nasdaq, Inc. (NASDAQ:NDAQ). Carlson Capital had $21.5 million invested in the company at the end of the quarter. Hugh Sloane’s Sloane Robinson Investment Management also made a $8.6 million investment in the stock during the quarter. The other funds with brand new NDAQ positions are Renaissance Technologies, Israel Englander’s Millennium Management, and Frank Slattery’s Symmetry Peak Management.

Let’s now review hedge fund activity in other stocks similar to Nasdaq, Inc. (NASDAQ:NDAQ). These stocks are The Cooper Companies, Inc. (NYSE:COO), D.R. Horton, Inc. (NYSE:DHI), CDW Corporation (NASDAQ:CDW), and Equifax Inc. (NYSE:EFX). All of these stocks’ market caps resemble NDAQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COO | 28 | 983218 | 0 |

| DHI | 47 | 2948879 | 1 |

| CDW | 29 | 1244470 | 1 |

| EFX | 34 | 1565232 | 10 |

| Average | 34.5 | 1685450 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.5 hedge funds with bullish positions and the average amount invested in these stocks was $1685 million. That figure was $115 million in NDAQ’s case. D.R. Horton, Inc. (NYSE:DHI) is the most popular stock in this table. On the other hand The Cooper Companies, Inc. (NYSE:COO) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Nasdaq, Inc. (NASDAQ:NDAQ) is even less popular than COO. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on NDAQ, though not to the same extent, as the stock returned 3.8% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.