Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

McKesson Corporation (NYSE:MCK) investors should be aware of an increase in support from the world’s most elite money managers lately. Our calculations also showed that MCK isn’t among the 30 most popular stocks among hedge funds.

Today there are many tools stock market investors can use to assess publicly traded companies. A couple of the most underrated tools are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can outpace their index-focused peers by a solid margin (see the details here).

We’re going to check out the latest hedge fund action surrounding McKesson Corporation (NYSE:MCK).

How have hedgies been trading McKesson Corporation (NYSE:MCK)?

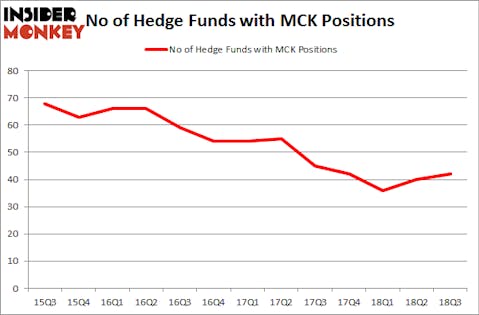

At Q3’s end, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MCK over the last 13 quarters. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Glenview Capital was the largest shareholder of McKesson Corporation (NYSE:MCK), with a stake worth $645.7 million reported as of the end of September. Trailing Glenview Capital was PAR Capital Management, which amassed a stake valued at $437.7 million. Pzena Investment Management, AQR Capital Management, and Baupost Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers were leading the bulls’ herd. Camber Capital Management, managed by Stephen DuBois, assembled the biggest position in McKesson Corporation (NYSE:MCK). Camber Capital Management had $99.5 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $92.8 million position during the quarter. The other funds with new positions in the stock are Samuel Isaly’s OrbiMed Advisors, Israel Englander’s Millennium Management, and Samuel Isaly’s OrbiMed Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as McKesson Corporation (NYSE:MCK) but similarly valued. These stocks are Paychex, Inc. (NASDAQ:PAYX), PPG Industries, Inc. (NYSE:PPG), DXC Technology Company (NYSE:DXC), and IQVIA Holdings, Inc. (NYSE:IQV). This group of stocks’ market valuations resemble MCK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAYX | 30 | 1076148 | 6 |

| PPG | 22 | 655098 | 3 |

| DXC | 50 | 2485422 | -6 |

| IQV | 48 | 4905001 | 2 |

| Average | 37.5 | 2280417 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.5 hedge funds with bullish positions and the average amount invested in these stocks was $2.28 billion. That figure was $2.98 billion in MCK’s case. DXC Technology Company (NYSE:DXC) is the most popular stock in this table. On the other hand PPG Industries, Inc. (NYSE:PPG) is the least popular one with only 22 bullish hedge fund positions. McKesson Corporation (NYSE:MCK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DXC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.