While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, virus news and stimulus spending, many smart money investors are starting to get cautious towards the current bull run since March, 2020 and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Kymera Therapeutics, Inc. (NASDAQ:KYMR).

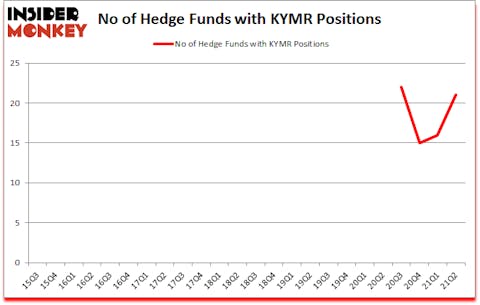

Is Kymera Therapeutics, Inc. (NASDAQ:KYMR) a buy right now? Prominent investors were taking an optimistic view. The number of bullish hedge fund bets improved by 5 recently. Kymera Therapeutics, Inc. (NASDAQ:KYMR) was in 21 hedge funds’ portfolios at the end of June. The all time high for this statistic is 22. Our calculations also showed that KYMR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most shareholders, hedge funds are assumed to be worthless, outdated investment vehicles of the past. While there are greater than 8000 funds with their doors open today, Our experts choose to focus on the moguls of this club, about 850 funds. Most estimates calculate that this group of people handle most of the smart money’s total asset base, and by monitoring their unrivaled stock picks, Insider Monkey has spotted various investment strategies that have historically exceeded the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Oleg Nodelman of EcoR1 Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to take a peek at the latest hedge fund action surrounding Kymera Therapeutics, Inc. (NASDAQ:KYMR).

Do Hedge Funds Think KYMR Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards KYMR over the last 24 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Mark Lampert’s Biotechnology Value Fund / BVF Inc has the number one position in Kymera Therapeutics, Inc. (NASDAQ:KYMR), worth close to $127.6 million, comprising 4.8% of its total 13F portfolio. Coming in second is Redmile Group, managed by Jeremy Green, which holds a $122.8 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions consist of Julian Baker and Felix Baker’s Baker Bros. Advisors, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Oleg Nodelman’s EcoR1 Capital. In terms of the portfolio weights assigned to each position Biotechnology Value Fund / BVF Inc allocated the biggest weight to Kymera Therapeutics, Inc. (NASDAQ:KYMR), around 4.78% of its 13F portfolio. Redmile Group is also relatively very bullish on the stock, dishing out 1.82 percent of its 13F equity portfolio to KYMR.

As aggregate interest increased, key hedge funds have jumped into Kymera Therapeutics, Inc. (NASDAQ:KYMR) headfirst. Clough Capital Partners, managed by Charles Clough, assembled the most valuable position in Kymera Therapeutics, Inc. (NASDAQ:KYMR). Clough Capital Partners had $4.9 million invested in the company at the end of the quarter. Ting Jia’s Octagon Capital Advisors also made a $4.9 million investment in the stock during the quarter. The following funds were also among the new KYMR investors: Steve Cohen’s Point72 Asset Management, Michael Rockefeller and KarláKroeker’s Woodline Partners, and Richard Driehaus’s Driehaus Capital.

Let’s check out hedge fund activity in other stocks similar to Kymera Therapeutics, Inc. (NASDAQ:KYMR). We will take a look at TechTarget Inc (NASDAQ:TTGT), Global Blood Therapeutics Inc (NASDAQ:GBT), Vector Group Ltd (NYSE:VGR), Rubius Therapeutics, Inc. (NASDAQ:RUBY), BGC Partners, Inc. (NASDAQ:BGCP), Repay Holdings Corporation (NASDAQ:RPAY), and SkyWest, Inc. (NASDAQ:SKYW). This group of stocks’ market valuations are similar to KYMR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTGT | 14 | 118269 | -3 |

| GBT | 16 | 456028 | -3 |

| VGR | 14 | 163192 | 0 |

| RUBY | 9 | 9743 | -2 |

| BGCP | 31 | 403945 | 10 |

| RPAY | 17 | 153116 | 2 |

| SKYW | 14 | 29113 | -3 |

| Average | 16.4 | 190487 | 0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.4 hedge funds with bullish positions and the average amount invested in these stocks was $190 million. That figure was $449 million in KYMR’s case. BGC Partners, Inc. (NASDAQ:BGCP) is the most popular stock in this table. On the other hand Rubius Therapeutics, Inc. (NASDAQ:RUBY) is the least popular one with only 9 bullish hedge fund positions. Kymera Therapeutics, Inc. (NASDAQ:KYMR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for KYMR is 65.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on KYMR as the stock returned 14.8% since the end of Q2 (through 10/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Kymera Therapeutics Inc. (NASDAQ:KYMR)

Follow Kymera Therapeutics Inc. (NASDAQ:KYMR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Blue Chip Dividend Stocks Hedge Funds Are Buying

- Top 15 Serial Entrepreneurs In The World

- 10 Best Precious Metals Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.