Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The one and a half month time period since the end of the third quarter is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Intercept Pharmaceuticals Inc (NASDAQ:ICPT).

Is Intercept Pharmaceuticals Inc (NASDAQ:ICPT) a splendid investment today? Investors who are in the know are in an optimistic mood. The number of long hedge fund bets went up by 1 in recent months. Our calculations also showed that ICPT isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the new hedge fund action regarding Intercept Pharmaceuticals Inc (NASDAQ:ICPT).

What does the smart money think about Intercept Pharmaceuticals Inc (NASDAQ:ICPT)?

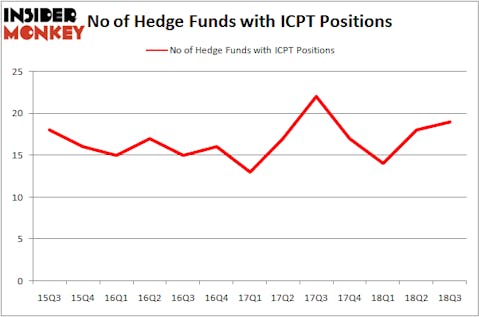

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ICPT over the last 13 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, Sarissa Capital Management held the most valuable stake in Intercept Pharmaceuticals Inc (NASDAQ:ICPT), which was worth $32.5 million at the end of the third quarter. On the second spot was Highfields Capital Management which amassed $30.2 million worth of shares. Moreover, D E Shaw, Citadel Investment Group, and Melqart Asset Management were also bullish on Intercept Pharmaceuticals Inc (NASDAQ:ICPT), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were breaking ground themselves. Perceptive Advisors, managed by Joseph Edelman, assembled the most valuable position in Intercept Pharmaceuticals Inc (NASDAQ:ICPT). Perceptive Advisors had $0.7 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $0.7 million investment in the stock during the quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Intercept Pharmaceuticals Inc (NASDAQ:ICPT) but similarly valued. These stocks are Selective Insurance Group, Inc. (NASDAQ:SIGI), AutoNation, Inc. (NYSE:AN), BankUnited, Inc. (NYSE:BKU), and Spire Inc. (NYSE:SR). This group of stocks’ market caps match ICPT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIGI | 10 | 36011 | 0 |

| AN | 24 | 430091 | 1 |

| BKU | 27 | 570820 | 5 |

| SR | 15 | 96507 | 2 |

| Average | 19 | 283357 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $283 million. That figure was $153 million in ICPT’s case. BankUnited, Inc. (NYSE:BKU) is the most popular stock in this table. On the other hand Selective Insurance Group, Inc. (NASDAQ:SIGI) is the least popular one with only 10 bullish hedge fund positions. Intercept Pharmaceuticals Inc (NASDAQ:ICPT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BKU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.