We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Equifax Inc. (NYSE:EFX).

Is Equifax Inc. (NYSE:EFX) undervalued? Investors who are in the know are becoming more confident. The number of bullish hedge fund bets inched up by 10 lately. Our calculations also showed that EFX isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the recent hedge fund action regarding Equifax Inc. (NYSE:EFX).

How are hedge funds trading Equifax Inc. (NYSE:EFX)?

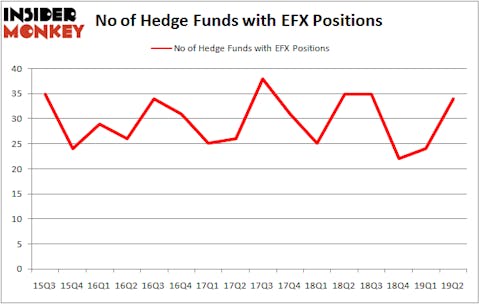

At the end of the second quarter, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in EFX over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Generation Investment Management was the largest shareholder of Equifax Inc. (NYSE:EFX), with a stake worth $438.2 million reported as of the end of March. Trailing Generation Investment Management was Cantillon Capital Management, which amassed a stake valued at $319.6 million. Farallon Capital, Senator Investment Group, and Egerton Capital Limited were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Egerton Capital Limited, managed by John Armitage, established the most valuable position in Equifax Inc. (NYSE:EFX). Egerton Capital Limited had $103.4 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also initiated a $78.1 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, David MacKnight’s One Fin Capital Management, and Bruce Kovner’s Caxton Associates LP.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Equifax Inc. (NYSE:EFX) but similarly valued. These stocks are First Republic Bank (NYSE:FRC), Maxim Integrated Products Inc. (NASDAQ:MXIM), SK Telecom Co., Ltd. (NYSE:SKM), and Principal Financial Group Inc (NASDAQ:PFG). This group of stocks’ market valuations are closest to EFX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRC | 22 | 657860 | 4 |

| MXIM | 28 | 254436 | 1 |

| SKM | 7 | 52977 | 1 |

| PFG | 17 | 113373 | 2 |

| Average | 18.5 | 269662 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $270 million. That figure was $1565 million in EFX’s case. Maxim Integrated Products Inc. (NASDAQ:MXIM) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (NYSE:SKM) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Equifax Inc. (NYSE:EFX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on EFX, though not to the same extent, as the stock returned 4.3% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.