We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees your average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Argan, Inc. (NYSEAMEX:AGX).

Is Argan, Inc. (NYSEAMEX:AGX) a good investment now? The smart money is becoming more confident. The number of long hedge fund bets rose by 1 lately. Our calculations also showed that AGX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are viewed as unimportant, outdated financial tools of years past. While there are more than 8000 funds trading at present, We choose to focus on the masters of this club, approximately 750 funds. These money managers watch over most of the hedge fund industry’s total asset base, and by tailing their inimitable picks, Insider Monkey has spotted several investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update.

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example, Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the latest hedge fund action encompassing Argan, Inc. (NYSEAMEX:AGX).

What does smart money think about Argan, Inc. (NYSEAMEX:AGX)?

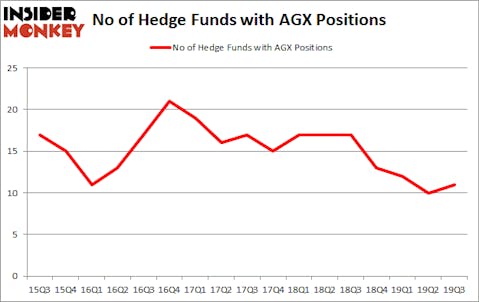

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in AGX over the last 17 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons (founder)’s Renaissance Technologies has the biggest position in Argan, Inc. (NYSEAMEX:AGX), worth close to $26 million, comprising less than 0.1%% of its total 13F portfolio. On Renaissance Technologies’s heels is Royce & Associates, led by Chuck Royce, holding a $24.5 million position; 0.2% of its 13F portfolio is allocated to the stock. Other peers that are bullish encompass David Brown’s Hawk Ridge Management, Martin Whitman’s Third Avenue Management and Leighton Welch’s Welch Capital Partners. In terms of the portfolio weights assigned to each position, Kokino LLC allocated the biggest weight to Argan, Inc. (NYSEAMEX:AGX), around 4.3% of its 13F portfolio. Hawk Ridge Management is also relatively very bullish on the stock, earmarking 1.4 percent of its 13F equity portfolio to AGX.

Now, some big names have been driving this bullishness. Winton Capital Management, managed by David Harding, assembled the biggest position in Argan, Inc. (NYSEAMEX:AGX). Winton Capital Management had $0.7 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.4 million investment in the stock during the quarter. The only other fund with a new position in the stock is Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Argan, Inc. (NYSEAMEX:AGX) but similarly valued. We will take a look at Heritage-Crystal Clean, Inc. (NASDAQ:HCCI), TigerLogic Corp. (NASDAQ:TIGR), Watford Holdings Ltd. (NASDAQ:WTRE), and Daqo New Energy Corp (NYSE:DQ). This group of stocks’ market valuations matches AGX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCCI | 12 | 68416 | 3 |

| TIGR | 1 | 147 | -3 |

| WTRE | 6 | 4622 | 3 |

| DQ | 10 | 21279 | 4 |

| Average | 7.25 | 23616 | 1.75 |

View the table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $73 million in AGX’s case. Heritage-Crystal Clean, Inc. (NASDAQ:HCCI) is the most popular stock in this table. On the other hand, TigerLogic Corp. (NASDAQ:TIGR) is the least popular one with only 1 bullish hedge fund position. Argan, Inc. (NYSEAMEX:AGX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately, AGX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on AGX were disappointed as the stock returned -6.1% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large-cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.