How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Oritani Financial Corp. (NASDAQ:ORIT).

Hedge fund interest in Oritani Financial Corp. (NASDAQ:ORIT) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Northfield Bancorp Inc (NASDAQ:NFBK), Franklin Street Properties Corp. (NYSEAMEX:FSP), and Carolina Financial Corporation (NASDAQ:CARO) to gather more data points.

Today there are many formulas shareholders have at their disposal to evaluate publicly traded companies. A couple of the most innovative formulas are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the top money managers can beat the broader indices by a solid margin (see the details here).

Let’s analyze the fresh hedge fund action regarding Oritani Financial Corp. (NASDAQ:ORIT).

Hedge fund activity in Oritani Financial Corp. (NASDAQ:ORIT)

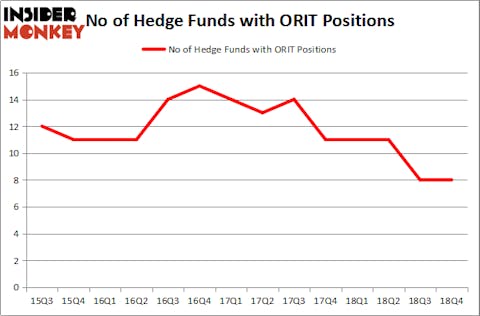

Heading into the first quarter of 2019, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in ORIT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Oritani Financial Corp. (NASDAQ:ORIT), which was worth $27.6 million at the end of the fourth quarter. On the second spot was Prospector Partners which amassed $6.5 million worth of shares. Moreover, Driehaus Capital, Two Sigma Advisors, and Citadel Investment Group were also bullish on Oritani Financial Corp. (NASDAQ:ORIT), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Millennium Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was D E Shaw).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Oritani Financial Corp. (NASDAQ:ORIT) but similarly valued. These stocks are Northfield Bancorp Inc (NASDAQ:NFBK), Franklin Street Properties Corp. (NYSEAMEX:FSP), Carolina Financial Corporation (NASDAQ:CARO), and Enova International Inc (NYSE:ENVA). This group of stocks’ market valuations match ORIT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NFBK | 4 | 29496 | 1 |

| FSP | 15 | 28612 | 8 |

| CARO | 8 | 41686 | 2 |

| ENVA | 23 | 147435 | 2 |

| Average | 12.5 | 61807 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $62 million. That figure was $40 million in ORIT’s case. Enova International Inc (NYSE:ENVA) is the most popular stock in this table. On the other hand Northfield Bancorp Inc (NASDAQ:NFBK) is the least popular one with only 4 bullish hedge fund positions. Oritani Financial Corp. (NASDAQ:ORIT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ORIT wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); ORIT investors were disappointed as the stock returned 15% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.