Before we spend many hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Lululemon Athletica Inc. (NASDAQ:LULU).

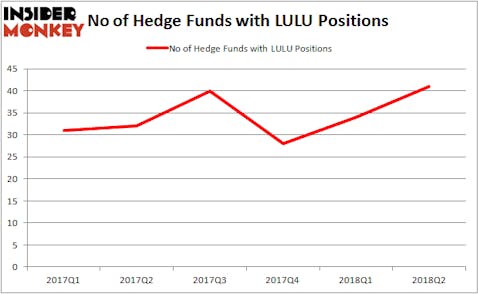

In short, they love it. Lululemon was owned by 41 of the hedge funds tracked by Insider Monkey’s database as of June 30, up from 34 at the end of March. That ranked it as Hedge Funds’ Favorite Apparel Stock, while it also landed on our list of the 25 Stocks Billionaires Are Piling On (though it didn’t crack the top 10). Lululemon is firing on all cylinders, which is investors have blessed it with nearly 80% gains in 2018. The recent pullback, which was macro-based, could be a golden opportunity for investors to grab discounted shares ahead of a holiday season that Lululemon appears poised to do very well during thanks to enhanced customer acquisition efforts, an expanded international presence, growing e-commerce platform, and new products that are resonating with customers.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action regarding Lululemon Athletica Inc. (NASDAQ:LULU).

What have hedge funds been doing with Lululemon Athletica Inc. (NASDAQ:LULU)?

Heading into the fourth quarter of 2018, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a 21% increase from one quarter earlier to hit an 18-month high. On the other hand, there were a total of 28 hedge funds with a bullish position in LULU at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Lululemon Athletica Inc. (NASDAQ:LULU), worth $271.2 million at the end of the second quarter. On the second spot was Two Sigma Advisors which had amassed $240.8 million worth of shares. Moreover, Shellback Capital and Laurion Capital Management were also bullish on Lululemon Athletica Inc. (NASDAQ:LULU), allocating a large percentage of their 13F portfolios to this stock.

As aggregate interest increased, key money managers were breaking ground themselves. Hitchwood Capital Management, managed by James Crichton, created the most valuable position in Lululemon Athletica Inc. (NASDAQ:LULU). Hitchwood Capital Management had $43.7 million invested in the company at the end of the second quarter. Louis Navellier’s Navellier & Associates also made a $2.6 million investment in the stock during the quarter. The following funds were also among the new LULU investors: Alexander Mitchell’s Scopus Asset Management, George Hall’s Clinton Group, and Robert Pohly’s Samlyn Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Lululemon Athletica Inc. (NASDAQ:LULU) but similarly valued. We will take a look at Snap Inc. (NYSE:SNAP), Xilinx, Inc. (NASDAQ:XLNX), and Smith & Nephew plc (ADR) (NYSE:SNN). This group of stocks’ market valuations resemble LULU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNAP | 15 | 723227 | -8 |

| XLNX | 28 | 1207133 | -2 |

| SNN | 7 | 298735 | -5 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $743 million. That figure was $1.79 billion in LULU’s case. Xilinx, Inc. (NASDAQ:XLNX) is the most popular stock in this table. On the other hand iShares U.S. Preferred Stock ETF (NASDAQ:PFF) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Lululemon Athletica Inc. (NASDAQ:LULU) is more popular among hedge funds. Considering that hedge funds can’t get enough of this stock, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.