Hedge funds started to disclose their holdings at the end of 2019 in new 13F filings. They have 45 days from the end of each quarter to disclose their positions in publicly traded US stocks, options, and convertible debt. Insider Monkey tracks more than 750 hedge funds and usually more than half of these hedge funds will wait until the last day to file their 13Fs with the SEC. Fortunately, our experience shows that aggregate hedge fund sentiment towards most stocks don’t change much. In this article we are going to take a look at how hedge funds have been feeling about a stock like Microsoft Corporation (NASDAQ:MSFT) and compare its performance against hedge funds’ favorite stocks.

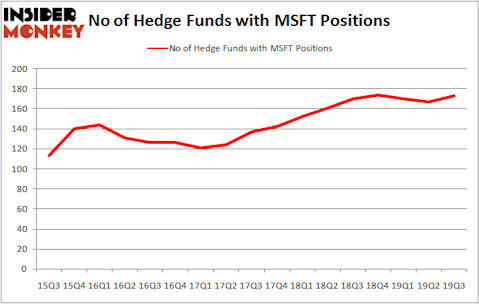

Microsoft Corporation (NASDAQ:MSFT) shareholders have witnessed an increase in enthusiasm from smart money in recent months. MSFT was in 173 hedge funds’ portfolios at the end of September. There were 167 hedge funds in our database with MSFT positions at the end of the previous quarter. Our calculations also showed that MSFT consistently ranked second or third among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings) in 2019.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that historically hedge funds’ stock picks outperformed the market by a large margin. That’s why hedge fund industry became a $3 trillion industry. However, you can’t outperform the market by replicating the entire portfolio of an average hedge fund anymore. Luckily Insider Monkey came up with proprietary algorithms to identify the best stock picks of the best hedge fund managers. We have been sharing a portfolio of around 15 hand picked stocks in our monthly newsletter since March 2017 and generated a cumulative return of 87% vs. 47.7% S&P 500 ETFs during the same period (see the details here).

We leave no stone unturned when looking for the next great investment idea. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap trading at an enterprise value/operating profit ratio of 1 (this isn’t a typo). In January, we recommended a position in a dividend stock with a PE ratio of less than 7 that is growing its earnings and yields 11%. With all of this in mind we’re going to take a gander at the key hedge fund action regarding Microsoft Corporation (NASDAQ:MSFT).

How have hedgies been trading Microsoft Corporation (NASDAQ:MSFT)?

At Q3’s end, a total of 173 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MSFT over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fisher Asset Management held the most valuable stake in Microsoft Corporation (NASDAQ:MSFT), which was worth $2969.5 million at the end of the third quarter. On the second spot was Eagle Capital Management which amassed $2625.1 million worth of shares. Tiger Global Management, AQR Capital Management, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Joho Capital allocated the biggest weight to Microsoft Corporation (NASDAQ:MSFT), around 21.93% of its 13F portfolio. Duquesne Capital is also relatively very bullish on the stock, earmarking 21.61 percent of its 13F equity portfolio to MSFT.

As one would reasonably expect, some big names were breaking ground themselves. Cryder Capital, managed by Ferdinand Groos, established the biggest position in Microsoft Corporation (NASDAQ:MSFT). Cryder Capital had $90.2 million invested in the company at the end of the quarter. Michael Sidhom’s Immersion Capital also initiated a $84.1 million position during the quarter. The other funds with new positions in the stock are David Fiszel’s Honeycomb Asset Management, Gregg Moskowitz’s Interval Partners, and Joseph Samuels’s Islet Management.

Let’s now review hedge fund activity in other stocks similar to Microsoft Corporation (NASDAQ:MSFT). We will take a look at Apple Inc. (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL), and Alphabet Inc (NASDAQ:GOOG). This group of stocks’ market values match MSFT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AAPL | 111 | 64813263 | 16 |

| AMZN | 168 | 22964901 | 5 |

| GOOGL | 147 | 12321541 | 18 |

| GOOG | 136 | 15584517 | 10 |

| Average | 140.5 | 28921056 | 12.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 140.5 hedge funds with bullish positions and the average amount invested in these stocks was $28921 million. That figure was $26910 million in MSFT’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table. On the other hand Apple Inc. (NASDAQ:AAPL) is the least popular one with only 111 bullish hedge fund positions. Compared to these stocks Microsoft Corporation (NASDAQ:MSFT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These 20 hedge fund hotels also returned 4.5% in 2020 and beat the market by an additional 3 percentage points. Hedge funds were also right about betting on MSFT as the stock returned 6.6% so far in 2020 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.