Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 57%. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 41.3% in 2019 and outperformed the broader market benchmark by 10.1 percentage points. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

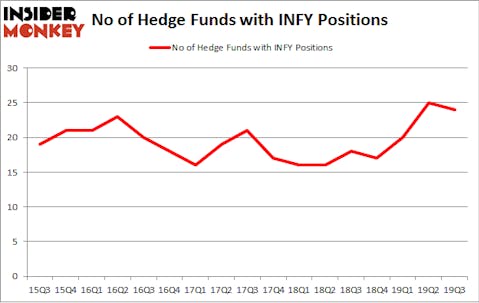

Is Infosys Limited (NYSE:INFY) an excellent investment today? The smart money is turning less bullish. The number of bullish hedge fund bets fell by 1 in recent months. Our calculations also showed that INFY isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). INFY was in 24 hedge funds’ portfolios at the end of September. There were 25 hedge funds in our database with INFY positions at the end of the previous quarter.

In the financial world there are several signals stock traders employ to assess publicly traded companies. Some of the most innovative signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can trounce the broader indices by a healthy amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now let’s take a look at the recent hedge fund action surrounding Infosys Limited (NYSE:INFY).

How are hedge funds trading Infosys Limited (NYSE:INFY)?

Heading into the fourth quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from the second quarter of 2019. By comparison, 18 hedge funds held shares or bullish call options in INFY a year ago. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Infosys Limited (NYSE:INFY), with a stake worth $427.6 million reported as of the end of September. Trailing Fisher Asset Management was GQG Partners, which amassed a stake valued at $374.3 million. Polaris Capital Management, AQR Capital Management, and LMR Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Polaris Capital Management allocated the biggest weight to Infosys Limited (NYSE:INFY), around 9.31% of its 13F portfolio. Sensato Capital Management is also relatively very bullish on the stock, earmarking 3.87 percent of its 13F equity portfolio to INFY.

Due to the fact that Infosys Limited (NYSE:INFY) has experienced falling interest from hedge fund managers, we can see that there were a few hedge funds that elected to cut their entire stakes heading into Q4. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the biggest investment of all the hedgies tracked by Insider Monkey, worth close to $31.1 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dumped its stock, about $6.1 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds heading into Q4.

Let’s go over hedge fund activity in other stocks similar to Infosys Limited (NYSE:INFY). We will take a look at Simon Property Group, Inc (NYSE:SPG), Global Payments Inc (NYSE:GPN), ServiceNow Inc (NYSE:NOW), and Norfolk Southern Corp. (NYSE:NSC). This group of stocks’ market valuations match INFY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPG | 25 | 698285 | -1 |

| GPN | 64 | 3524604 | 27 |

| NOW | 86 | 5263766 | 9 |

| NSC | 46 | 1947473 | -8 |

| Average | 55.25 | 2858532 | 6.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 55.25 hedge funds with bullish positions and the average amount invested in these stocks was $2859 million. That figure was $1438 million in INFY’s case. ServiceNow Inc (NYSE:NOW) is the most popular stock in this table. On the other hand Simon Property Group, Inc (NYSE:SPG) is the least popular one with only 25 bullish hedge fund positions. Compared to these stocks Infosys Limited (NYSE:INFY) is even less popular than SPG. Hedge funds dodged a bullet by taking a bearish stance towards INFY. Our calculations showed that the top 20 most popular hedge fund stocks returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately INFY wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); INFY investors were disappointed as the stock returned 11.9% in 2019 and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.