Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of Elastic N.V. (NYSE:ESTC) based on that data.

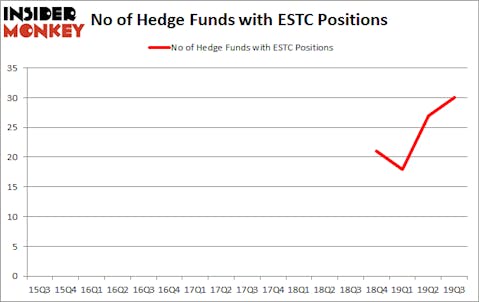

Elastic N.V. (NYSE:ESTC) investors should be aware of an increase in hedge fund sentiment recently. ESTC was in 30 hedge funds’ portfolios at the end of the third quarter of 2019. There were 27 hedge funds in our database with ESTC holdings at the end of the previous quarter. Our calculations also showed that ESTC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Dmitry Balyasny of Balyasny Asset Managemnet

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind let’s check out the new hedge fund action surrounding Elastic N.V. (NYSE:ESTC).

How are hedge funds trading Elastic N.V. (NYSE:ESTC)?

Heading into the fourth quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in ESTC a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

More specifically, Sylebra Capital Management was the largest shareholder of Elastic N.V. (NYSE:ESTC), with a stake worth $248.3 million reported as of the end of September. Trailing Sylebra Capital Management was Holocene Advisors, which amassed a stake valued at $96.4 million. Whale Rock Capital Management, Alkeon Capital Management, and Tairen Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sylebra Capital Management allocated the biggest weight to Elastic N.V. (NYSE:ESTC), around 10.85% of its 13F portfolio. Tairen Capital is also relatively very bullish on the stock, dishing out 10.4 percent of its 13F equity portfolio to ESTC.

Now, key hedge funds have jumped into Elastic N.V. (NYSE:ESTC) headfirst. Whale Rock Capital Management, managed by Alex Sacerdote, established the largest position in Elastic N.V. (NYSE:ESTC). Whale Rock Capital Management had $87.6 million invested in the company at the end of the quarter. Larry Chen and Terry Zhang’s Tairen Capital also made a $70.7 million investment in the stock during the quarter. The following funds were also among the new ESTC investors: Josh Resnick’s Jericho Capital Asset Management, Dmitry Balyasny’s Balyasny Asset Management, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Elastic N.V. (NYSE:ESTC) but similarly valued. These stocks are Genesee & Wyoming Inc (NYSE:GWR), Dr. Reddy’s Laboratories Limited (NYSE:RDY), The Madison Square Garden Company (NASDAQ:MSG), and Morningstar, Inc. (NASDAQ:MORN). This group of stocks’ market valuations are closest to ESTC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GWR | 31 | 783531 | 5 |

| RDY | 13 | 95340 | 2 |

| MSG | 45 | 1729215 | -5 |

| MORN | 24 | 258250 | 4 |

| Average | 28.25 | 716584 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $717 million. That figure was $867 million in ESTC’s case. The Madison Square Garden Company (NASDAQ:MSG) is the most popular stock in this table. On the other hand Dr. Reddy’s Laboratories Limited (NYSE:RDY) is the least popular one with only 13 bullish hedge fund positions. Elastic N.V. (NYSE:ESTC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately ESTC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ESTC were disappointed as the stock returned -9.5% in 2019 (through December 23rd) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.