Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. Nevertheless, it is also possible to identify cheap large cap stocks by following the footsteps of best performing hedge funds. In this article we are going to take a look at smart money sentiment towards Apple Inc. (NASDAQ:AAPL).

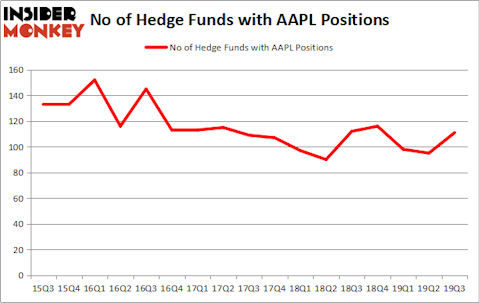

Apple Inc. (NASDAQ:AAPL) was in 111 hedge funds’ portfolios at the end of September. AAPL investors should be aware of an increase in hedge fund interest of late. There were 95 hedge funds in our database with AAPL holdings at the end of the previous quarter. Our calculations also showed that AAPL currently ranks #9 among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

According to most traders, hedge funds are viewed as underperforming, old financial vehicles of years past. While there are over 8000 funds in operation at the moment, Our researchers hone in on the moguls of this group, about 750 funds. These investment experts control most of all hedge funds’ total asset base, and by tailing their finest investments, Insider Monkey has uncovered numerous investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now let’s review the new hedge fund action encompassing Apple Inc. (NASDAQ:AAPL).

How are hedge funds trading Apple Inc. (NASDAQ:AAPL)?

Heading into the fourth quarter of 2019, a total of 111 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the previous quarter. On the other hand, there were a total of 112 hedge funds with a bullish position in AAPL a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Berkshire Hathaway, managed by Warren Buffett, holds the most valuable position in Apple Inc. (NASDAQ:AAPL). Berkshire Hathaway has a $55.7324 billion position in the stock, comprising 26% of its 13F portfolio. The second most bullish fund manager is Fisher Asset Management, led by Ken Fisher, holding a $3.1449 billion position; 3.5% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions contain Cliff Asness’s AQR Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Berkshire Hathaway allocated the biggest weight to Apple Inc. (NASDAQ:AAPL), around 25.96% of its 13F portfolio. Skylands Capital is also relatively very bullish on the stock, designating 9.23 percent of its 13F equity portfolio to AAPL.

Consequently, key hedge funds have jumped into Apple Inc. (NASDAQ:AAPL) headfirst. Alkeon Capital Management, managed by Panayotis Takis Sparaggis, created the most valuable call position in Apple Inc. (NASDAQ:AAPL). Alkeon Capital Management had $537.5 million invested in the company at the end of the quarter. Brian Ashford-Russell and Tim Woolley’s Polar Capital also initiated a $224 million position during the quarter. The following funds were also among the new AAPL investors: Anand Parekh’s Alyeska Investment Group, Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital, and Brandon Haley’s Holocene Advisors.

Let’s check out hedge fund activity in other stocks similar to Apple Inc. (NASDAQ:AAPL). We will take a look at Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL), Alphabet Inc (NASDAQ:GOOG), and Berkshire Hathaway Inc. (NYSE:BRK-B). This group of stocks’ market caps are similar to AAPL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMZN | 168 | 22964901 | 5 |

| GOOGL | 147 | 12321541 | 18 |

| GOOG | 136 | 15584517 | 10 |

| BRK-B | 99 | 22272006 | 6 |

| Average | 137.5 | 18285741 | 9.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 137.5 hedge funds with bullish positions and the average amount invested in these stocks was $18286 million. That figure was $64813 million in AAPL’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table. On the other hand Berkshire Hathaway Inc. (NYSE:BRK-B) is the least popular one with only 99 bullish hedge fund positions. Apple Inc. (NASDAQ:AAPL) is not as popular as these stocks but that’s only because Amazon and Google are top 5 hedge fund stocks. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on AAPL as the stock returned 82.7% in 2019 through December 23rd and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.