Och-Ziff Hedge Fund Had $7.6 Billion in Outflows Last Year (Bloomberg)

Och-Ziff Capital Management Group LLC saw $7.6 billion in client withdrawals last year despite posting the best performance in his flagship hedge fund since 2013, the company said in a statement Friday. Still, the firm, founded by the former arbitrage trader in 1994, collected inflows to start 2018 off right. While redemptions have slowed, Och’s New York-based firm had a tumultuous time as it grappled with the aftermath of settling a five-year bribery probe, last-minute changes to Och’s succession plan, and its shares hitting record lows. It’s now up to Robert Shafir, a former executive at Credit Suisse Group AG who succeeded Och as chief executive officer on Feb. 5, to lead the turnaround.

Backstory: Warren Buffett’s Valentine’s Day Surprise for Investors (Reuters)

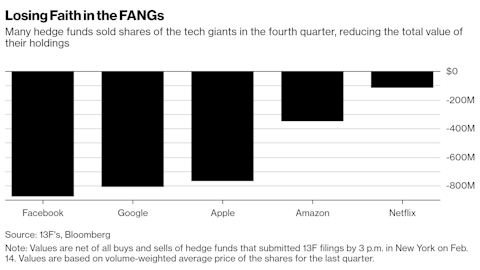

NEW YORK (Reuters) – Warren Buffett had a Valentine’s Day surprise for investors in Teva Pharmaceutical Industries Ltd (TEVA.TA). A regulatory filing with the U.S. Securities and Exchange Commission (SEC), known as a 13F, showed that Buffett’s Berkshire Hathaway Inc (BRKa.N) took a stake in the generic drugmaker in the fourth quarter of 2017. The news pushed Teva shares up more than 10 percent on Feb. 14. Hedge funds are notably hush hush about their portfolio holdings. Quarterly disclosures offer a look at what influential money managers are buying and selling.

Maxx-Studio/Shutterstock.com

Bezeq Is Said to Accept Elliott Demand to Hire New Directors (Bloomberg)

Bezeq Israeli Telecommunication Corp. plans to bow to demands from hedge fund Elliott Management Corp. that it hire new directors to run the company, according to a person familiar with the matter. Bezeq’s board of directors will form a subcommittee with members who aren’t linked to majority shareholder Shaul Elovitch to find new directors for the firm, said the person, asking not to be identified because the discussions are private. The committee will also work with an executive search firm to make the hiring process more transparent, the person said. Elliott, the New York-based fund founded by billionaire Paul Singer, in January increased its stake in Bezeq, Israel’s largest telecommunications firm, and called for changes to its ownership structure to improve its flagging performance.

Soros Lobbies ECB for More Euro Zone Integration, Draws Criticism (Reuters)

FRANKFURT (Reuters) – Billionaire investor and activist George Soros has met a European Central Bank director to argue for closer euro zone integration, prompting criticism from some EU lawmakers who fear he is exerting undue influence on a sensitive political issue. The Hungarian-born financier is a veteran advocate of European unity whose championing of liberal causes over decades has earned him many enemies, including Hungary’s nationalist Prime Minister Viktor Orban and some Brexit supporters. Soros held a private meeting on Nov. 14 with Benoit Coeure, a member of the six-strong board that steers ECB policy, to discuss “euro area deepening”, according to a part of Coeure’s diary published on Thursday.

Dan Loeb Ready To Pitch New Hedge Fund Drama (DealBreaker)

A few years ago, Dan Loeb offered some unsolicited film criticism. This did not go over well in his hometown, where he was met with the withering scorn of George Clooney. That George Clooney likely has no idea that Loeb is a native Angeleno takes none of the sting out that “carpetbagger” put-down. Anyway, in the face of Clooneyan wrath, Loeb had to rather humiliatingly back down. But dammit if he doesn’t still want to be in pictures. Dan Loeb’s Third Point hedge fund took a 2 million share stake in Netflix in the fourth quarter of last year, according to a filing released Wednesday…

Brevan Howard Opens Back-Office Unit to Hedge Fund Rivals (FNLondon.com)

Brevan Howard Asset Management is spinning out its back-office operations to create a platform to host rival hedge fund managers. The as-yet unnamed business will provide a new source of revenues for the firm, which has seen a decline in assets — from a peak of $40bn in 2013 to $13bn in 2017 — during a difficult period for global macro managers. The move comes as firms, including Fortress Investment Group and DE Shaw Group, take similar steps to profit from a growing number of money managers looking to cut fixed costs by outsourcing their requirements, including compliance and risk management, to third parties.

Insider Selling: NVIDIA Co. (NVDA) Director Sells $3,944,784.51 in Stock (WeekHerald.com)

NVIDIA Co. (NASDAQ:NVDA) Director Mark L. Perry sold 17,307 shares of the firm’s stock in a transaction dated Monday, February 12th. The shares were sold at an average price of $227.93, for a total value of $3,944,784.51. Following the transaction, the director now owns 30,762 shares in the company, valued at $7,011,582.66. The transaction was disclosed in a document filed with the Securities & Exchange Commission.

Everspin Technologies Inc (MRAM) Insider Purchases $99,995.00 in Stock (TheLincolnianOnline.com)

Everspin Technologies Inc (NASDAQ:MRAM) insider Kevin Conley purchased 14,285 shares of the business’s stock in a transaction on Monday, February 12th. The shares were purchased at an average price of $7.00 per share, with a total value of $99,995.00. Following the acquisition, the insider now directly owns 24,285 shares in the company, valued at $169,995. The acquisition was disclosed in a filing with the SEC.

Insider Buying: StoneMor Partners L.P. (STON) Major Shareholder Acquires $540,000.00 in Stock (DispatchTribunal.com)

StoneMor Partners L.P. (NYSE:STON) major shareholder Value Equity Fund Gp L. Oaktree bought 100,000 shares of the firm’s stock in a transaction on Tuesday, February 13th. The shares were purchased at an average price of $5.40 per share, for a total transaction of $540,000.00. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Large shareholders that own at least 10% of a company’s shares are required to disclose their sales and purchases with the SEC.

GMS Inc (GMS) Insider Sells $1,072,322.61 in Stock (WeekHerald)

GMS Inc (NYSE:GMS) insider G Michael Callahan, Jr. sold 33,333 shares of the stock in a transaction on Monday, February 12th. The stock was sold at an average price of $32.17, for a total value of $1,072,322.61. Following the transaction, the insider now owns 461,752 shares of the company’s stock, valued at $14,854,561.84. The transaction was disclosed in a filing with the Securities & Exchange Commission.

Insider Buying: Halcon Resources Co. (HK) Director Buys $7,682,915.40 in Stock (LedgerGazette.com)

Halcon Resources Co. (NYSE:HK) Director Ares Management Llc bought 1,113,466 shares of the stock in a transaction dated Friday, February 9th. The stock was purchased at an average cost of $6.90 per share, with a total value of $7,682,915.40. Following the completion of the purchase, the director now directly owns 53,114 shares in the company, valued at approximately $366,486.60. The purchase was disclosed in a filing with the Securities & Exchange Commission.

Insider Buying: Harvest Capital Credit Corp (HCAP) Major Shareholder Purchases 9,780 Shares of Stock (Baseballnewssource.com)

Harvest Capital Credit Corp (NASDAQ:HCAP) major shareholder Jmp Group Llc acquired 9,780 shares of Harvest Capital Credit stock in a transaction dated Tuesday, February 13th. The shares were acquired at an average cost of $10.58 per share, with a total value of $103,472.40. The purchase was disclosed in a legal filing with the Securities & Exchange Commission.