The market has been volatile as the Federal Reserve continues its rate hikes to normalize interest rates. Small-cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in October. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of The Hartford Financial Services Group, Inc. (NYSE:HIG) and find out how it could be affected by hedge funds’ moves.

Hedge fund ownership of The Hartford Financial Services Group, Inc. (NYSE:HIG) dipped slightly in Q2, but they remain on the company overall, with 37 funds owning 9.40% of its stock. Ray Dalio’s Bridgewater Associates (9,346 shares) and Glenn Russell Dubin’s Highbridge Capital Management (200,000 shares) opened new HIG stakes in Q2, helping push the stock into a surprising 3rd place on our look at the 25 Stocks Billionaires Are Piling On. Investors can’t seem to find much to dislike about The Hartford Financial Services Group, Inc. (NYSE:HIG), as less than 1% of the company’s shares are being sold short.

According to most market participants, hedge funds are perceived as underperforming, old financial tools of years past. While there are greater than 8,000 funds trading at present, our experts choose to focus on the elite of this club, approximately 700 funds. These investment experts administer most of the smart money’s total capital, and by shadowing their matchless picks, Insider Monkey has come up with a few investment strategies that have historically surpassed Mr. Market. Insider Monkey’s small-cap hedge fund strategy beat the S&P 500 index by 12 percentage points per annum for a decade in their back tests.

How are hedge funds trading The Hartford Financial Services Group, Inc. (NYSE:HIG)?

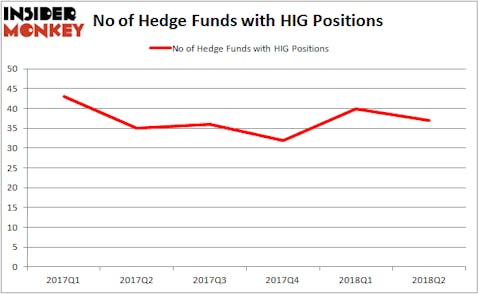

Heading into the fourth quarter of 2018, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a decline of 8% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards HIG over the last 6 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Andreas Halvorsen’s Viking Global held the most valuable stake in The Hartford Financial Services Group, Inc. (NYSE:HIG), which was worth $296.2 million at the end of the second quarter. On the second spot was Balyasny Asset Management which had amassed $190.8 million worth of shares. Moreover, Capital Returns Management, East Side Capital (RR Partners), and York Capital Management were also bullish on The Hartford Financial Services Group, Inc. (NYSE:HIG), allocating a large percentage of their portfolios to this stock.

Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest position of the 700 funds tracked by Insider Monkey, comprising close to $4.6 million in stock, and Daniel Lascano’s Lomas Capital Management was right behind this move, as the fund said goodbye to about $3.1 million in shares. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds in the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Hartford Financial Services Group, Inc. (NYSE:HIG) but similarly valued. We will take a look at Shinhan Financial Group Co., Ltd. (ADR) (NYSE:SHG), ABIOMED, Inc. (NASDAQ:ABMD), Wynn Resorts, Limited (NASDAQ:WYNN), and TransDigm Group Incorporated (NYSE:TDG). All of these stocks’ market caps resemble HIG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHG | 3 | 5753 | -2 |

| ABMD | 24 | 1660743 | 4 |

| WYNN | 44 | 2191894 | -6 |

| TDG | 41 | 3961067 | 4 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1.96 billion. That figure was $1.71 billion in HIG’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Shinhan Financial Group Co., Ltd. (ADR) (NYSE:SHG) is the least popular one with only 3 bullish hedge fund positions. The Hartford Financial Services Group, Inc. (NYSE:HIG) is not the most popular stock in this group but hedge fund interest is still above average and billionaires like it, so it may be worth looking into this stuck further and considering it for your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.