Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR) is not running out of steam. The company’s stock had rallied beginning May 8 to trade at a new 52-week high of $81.70 on May 20, but is now down to $73 per share (May 28 after-hours). However, the stock might resume its journey north once again.

The rally was triggered by the company’s announcement of an extended relationship with Starbucks Corporation (NASDAQ:SBUX) on K-Cup sales. This ended speculation over a possible fallout in their relationship following Starbucks Corporation (NASDAQ:SBUX)’ launch of its own single serve brewer of espresso drinks. Following the signing of the new five-year deal, Starbucks will now add Seattle’s Best and Torrefazione Italia coffees, Teavana teas, and Starbucks Corporation (NASDAQ:SBUX) cocoa to the K-Cup line up.

There are quite a number of factors attributable to the stock’s current slump. The company’s K-Cup sales declined 35% in April and dipped further by 21% in May. There are different theories out there with regard to the consecutive declines. Some think it has something to do with weather, whereas others believe that the industry overall is experiencing a slowdown.

Analysts from Wells Fargo and SunTrust believe that this is something to do with untimely promotions, coupled with a bit of what the rest have suggested. All these factors can only be temporary, the more reason we should look at something else in determining Green Mountain’s long-term destination. Analysts have also reiterated their Buy rating on the stock despite its recent plunge.

Green Mountain is financially stable and has a strong outlook

With a debt-to-equity ratio of 0.15,Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR) has a very stable financial position. However, its quick ratio of 1.18 is just enough to manage the company’s short-term obligations. Nonetheless, the company is financially sound, and faces no risk in meeting any of its debt obligations. The other factor to look at is its profitability margins, which are quite impressive. A gross margin of 46.8% is very good for a processed foods company. The company also boasts a strong profit margin of 13.17%, which is well above the industry average.

Results from the most recent quarter were very impressive with the company’s profits rising 42.3% to $132.4 million compared to last year’s $93.03 million. Analysts expect Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR) to better last year’s EPS of $2.28 by $0.88. This would translate to about $3.16 in earnings per share for the current fiscal year. However, the revenue growth rate is not the best in the industry as it stands at a paltry 13.5% compared to the industry average of 35.1%.

Valuation

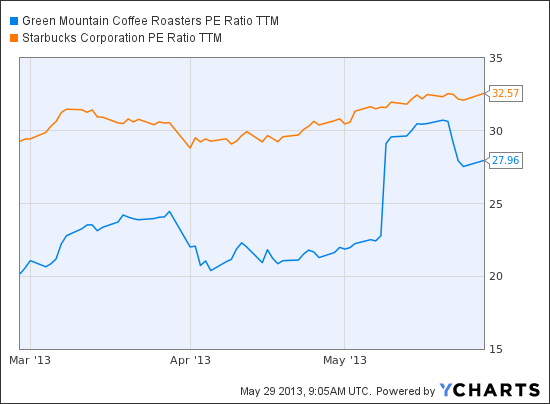

GMCR PE Ratio TTM data by YCharts

With a price to earnings ratio of 28.09, Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR) is one of the most expensive stocks in its industry, trading well above industry average of 21.33. However, its closest rival in terms of financial stability and outlook, Starbucks, is a little more expensive trading at 32.65 times earnings. This implies that the company’s stock price is driven by outlook supported by strong margins and the earnings growth rate.

Green Mountain trumps Starbucks in every department including quarterly earnings growth rate, with that of Starbucks standing at 26%. Despite Green Mountain’s dismal revenue growth rate compared to the industry average, it still beats Starbucks which has a figure of 11.3% from the most recent quarter.

Green Mountain’s other direct rival, Farmer Brothers Co. (NASDAQ:FARM), is the underdog of the trio. The Torrance, CA-based processed and packaged goods company is not profitable, and even has a negative operating margin. Its debt-to-equity ratio of 49.35 is the highest among the trio, with Starbucks’ standing at 10.32.

Farmer Brothers Co. (NASDAQ:FARM)’ revenue from the most recent quarter grew 4%. However, its gross margin is relatively strong at 38%. The company recently launched a new line of Iced Teas including Sweetened, Citrus Green, Sweet Jamaican Tropical, Georgia Peach, and Catalina Lemonade, developed in a bid to meet rising consumer demand. This comes at an opportune time when demand for regular coffee is declining due to a change in the weather.

The bottom line

Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR) has eliminated the doubt whether its partnership with Starbucks would continue after the Seattle, WA-based brewer launched a competing product. However, the signing of a five-year deal, which also adds new products to the K-Cups line, rubber-stamps the strength of the relationship, which should guarantee consistent sales numbers going forward for the next five years.

Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR)’s fundamentals remain strong, with a very stable financial position and impressive margins. The revenue growth rate is not the best in the industry, but at least it trumps a majority of the companies, including Starbucks. The earnings growth margins are the best in the industry, and with a projected EPS of $3.16 per share for the current fiscal year, the company is well placed to trade higher, maintaining the current PE ratio of 28.09. Therefore, the race is not over, the stock is just catching a breath.

The article This Stock Is Not Running Out of Steam originally appeared on Fool.com and is written by Nicholas Kitonyi.

Nicholas Kitonyi has no position in any stocks mentioned. The Motley Fool recommends Green Mountain Coffee Roasters and Starbucks. The Motley Fool owns shares of Starbucks. Nicholas is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.