World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

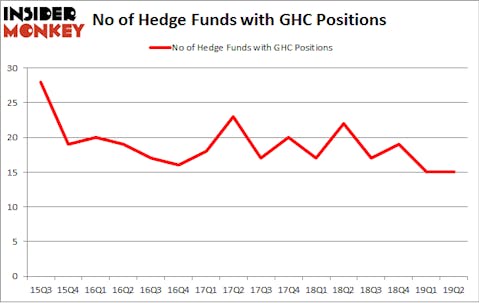

Graham Holdings Company (NYSE:GHC) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 15 hedge funds’ portfolios at the end of the second quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Texas Roadhouse Inc (NASDAQ:TXRH), Axon Enterprise, Inc. (NASDAQ:AAXN), and Globant SA (NYSE:GLOB) to gather more data points. Our calculations also showed that VVV isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most traders, hedge funds are seen as worthless, old investment vehicles of years past. While there are over 8000 funds with their doors open today, We choose to focus on the bigwigs of this club, approximately 750 funds. These investment experts shepherd the majority of the smart money’s total capital, and by watching their first-class equity investments, Insider Monkey has spotted many investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the key hedge fund action encompassing Graham Holdings Company (NYSE:GHC).

Hedge fund activity in Graham Holdings Company (NYSE:GHC)

At the end of the second quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the first quarter of 2019. By comparison, 22 hedge funds held shares or bullish call options in GHC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Southeastern Asset Management held the most valuable stake in Graham Holdings Company (NYSE:GHC), which was worth $321.7 million at the end of the second quarter. On the second spot was AQR Capital Management which amassed $109.2 million worth of shares. Moreover, Wallace Capital Management, Renaissance Technologies, and GLG Partners were also bullish on Graham Holdings Company (NYSE:GHC), allocating a large percentage of their portfolios to this stock.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the second quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Graham Holdings Company (NYSE:GHC) but similarly valued. We will take a look at Texas Roadhouse Inc (NASDAQ:TXRH), Axon Enterprise, Inc. (NASDAQ:AAXN), Globant SA (NYSE:GLOB), and Bank OZK (NASDAQ:OZK). This group of stocks’ market caps resemble GHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TXRH | 23 | 257119 | -2 |

| AAXN | 16 | 250261 | -3 |

| GLOB | 14 | 63286 | -6 |

| OZK | 21 | 285631 | 1 |

| Average | 18.5 | 214074 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $214 million. That figure was $563 million in GHC’s case. Texas Roadhouse Inc (NASDAQ:TXRH) is the most popular stock in this table. On the other hand Globant SA (NYSE:GLOB) is the least popular one with only 14 bullish hedge fund positions. Graham Holdings Company (NYSE:GHC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately GHC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); GHC investors were disappointed as the stock returned -3.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.