In this article, we will take a look at the 10 Best AI Stocks to Buy According to Goldman Sachs.

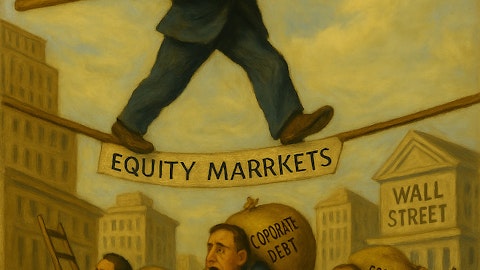

Artificial Intelligence has driven the stock market to all-time highs as the industry continues to grow and expand. Goldman Sachs recently warned that once AI spending slows down, the stock market can dip by 20%. Currently, major tech companies are investing heavily in AI infrastructure and software development. Goldman Sachs analyst Ryan Hammond in the firm’s research note pointed to the risk of hyperscalers certainly cutting back on AI expenditures.

READ ALSO: 10 Most Promising Technology Stocks to Invest In and 11 Low Price High Volume Stocks to Buy According to Analysts.

“A reversion of long-term growth estimates back to early 2023 levels would imply 15% to 20% downside to the current valuation multiple of the S&P 500,” Hammond added in the research note.

At the moment, AI spending seems to be steaming ahead, but Hammond cited that a few analysts are expecting a sharp deceleration to take place in Q4 2025 and 2026.

Goldman Sachs analyst Eric Sheridan appeared on Yahoo Finance’s Opening Bid on September 8 and shared his thoughts on the AI market and labor market data. Sheridan said that the labor market has an impact on the technology field. Companies are balancing legacy operating cost efficiencies with the need to reinvest in the forward AI curve over the next three to five years.

“Most of the companies I cover have had low to no net employee growth over the last six to eight quarters as they’ve realigned their organizations for where they’re going over the longer term with respect to AI. It’s sort of pulling OPEX out of the business model with an eye towards putting that capital back into capital expenditures that go toward the infrastructure layer,” said Sheridan.

Sheridan further added that the AI industry is seeing a transition from an infrastructure layer investment theme towards an application theme. The market is experiencing differences in AI applications deployed by consumers and by enterprises. Enterprises have restricted budget requirements, while people are more likely to adopt AI in a consumer computing environment compared to enterprise computing networks.

“I think at the end of the day you are seeing very different skews about AI being adopted between consumers and enterprises,” noted Sheridan.

The analysts believe that AI will see different trajectories over the long term as the companies continue to shift their strategies across different phases of AI growth.

With these trends in view, let’s take a look at the 10 Best AI Stocks to Buy According to Goldman Sachs.

Source: unsplash

Our Methodology

To compile the list of 10 best AI stocks to buy according to Goldman Sachs, we shortlisted the 10 AI companies with the highest stakes held by Goldman Sachs’ investment fund. We ranked these companies in ascending order of the Goldman Sachs portfolio percentage in the stock. We have also added the total number of hedge funds holding stakes in these companies. The data for hedge funds is taken from Insider Monkey’s Hedge Fund database, updated as of Q2 2025.

Note: The data was recorded on September 23.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

Goldman Sachs AI Stocks: 10 Stocks to Buy

10. Palantir Technologies Inc. (NASDAQ:PLTR)

Percentage of Portfolio Holding: 0.33%

Portfolio Holding Value: $2.44 Billion

Number of Hedge Fund Holders: 78

Palantir Technologies Inc. (NASDAQ:PLTR) is one of the best AI stocks to buy according to Goldman Sachs. On September 18, Palantir Technologies Inc. (NASDAQ:PLTR) received a military AI contract from the U.K. government worth £750 million.

The U.K.’s Defence Secretary John Healey signed a deal with Palantir expected to be around £750 million. Palantir’s AI technology will enable British forces commanders to efficiently identify targets on the battlefield. Palantir’s technology will be integrated into the British Armed Forces network to upgrade their AI-powered capabilities and assist in decision-making, military planning, and targeting.

“This partnership is a major vote of confidence in UK leadership in defence, data, and AI technology, and as an ideal location for companies to invest and expand. By harnessing the power of AI, we will boost the effectiveness of our Armed Forces, ensuring they have the tools they need to keep the British people safe. The work will unlock billions of pounds of investment into UK innovation, creating hundreds of skilled UK jobs and making defence the leading edge of innovation in NATO,” said Defence Secretary John Healey.

The U.K. Armed Forces commanders will be able to obtain real-time battlefield awareness from warships to tanks to cruise missiles. The technology is already operational for naval border defence through Project Kraken. Palantir’s core technology services assist in complete visibility from manpower gaps to channel shipping. This deal is a fundamental shift from human-driven military planning to AI-powered force readiness and war management.

Following the announcement, Palantir Technologies Inc. (NASDAQ:PLTR) surged over 6.53% on September 23.

Palantir Technologies Inc. (NASDAQ:PLTR) offers software to assist in counterterrorism investigations and operations. The company has created four principal software platforms, including Gotha, Foundry, Apollo, and Palantir AI Platform (AIP).

9. Oracle Corporation (NYSE:ORCL)

Percentage of Portfolio Holding: 0.37%

Portfolio Holding Value: $2.72 Billion

Number of Hedge Fund Holders: 124

Oracle Corporation (NYSE:ORCL) is one of the best AI stocks to buy according to Goldman Sachs. On September 17, Moody’s Ratings flagged significant ‘counterparty risk’ for Oracle Corporation (NYSE:ORCL) following its $300 billion AI contract with OpenAI.

Oracle is set to provide 4.5 gigawatts of compute to OpenAI over the next five years, which Moody’s sees as overwhelming for the company. The credit rating agency believes that this deal has tremendous potential for Oracle’s AI infrastructure business. But Moody’s also pointed out Oracle’s pipeline isn’t swelling; it is locking in. Moody’s has lowered the credit rating outlook to negative from stable, issuing a rating of Baa2, which is at the lower end of investment-grade credit ratings.

“Counterparty risk is always a key consideration in any type of project financing, particularly where there is a high reliance on revenue from a single counterparty. And in our view, Oracle’s data center build is effectively one of, if not the world’s largest, project financing,” according to Moody’s analyst.

The analyst also noted that the company’s debt will increase faster than its EBITDA, which could add to a forecast high leverage of 4x before Oracle’s EBITDA begins to surpass its debt.

“It is likely that free cash flow will also be negative for an extended period before reaching breakeven,” the analyst added.

The rating agency specifically highlighted the growing counterparty risk with Oracle, relying on major commitments from a small number of AI companies to fund its business model.

Since the Moody’s credit rating downgrade, Oracle Corporation (NYSE:ORCL) shares have plunged over 6.65% as of September 23.

Oracle Corporation (NYSE:ORCL) is a leading provider of integrated suites of applications, including secure, autonomous infrastructure in the Oracle Cloud. The company’s Oracle Cloud Infrastructure for AI computing is offering AI-powered applications and services.

8. Eli Lilly and Company (NYSE:LLY)

Percentage of Portfolio Holding: 0.58%

Portfolio Holding Value: $4.29 Billion

Number of Hedge Fund Holders: 119

Eli Lilly and Company (NYSE:LLY) is one of the best AI stocks to buy according to Goldman Sachs. On September 18, Wells Fargo reiterated a Buy rating on Eli Lilly and Company (NYSE:LLY) stock, maintaining the price target at $1,100.

Mohit Bansal from Wells Fargo reaffirmed his rating on LLY following the company’s announcement to invest $5 billion in a Virginia plant for cancer drugs. On September 16, Eli Lilly announced that it plans to build a $5 billion manufacturing facility, the company’s first dedicated, fully integrated active pharmaceutical independent and drug product facility for its emerging bioconjugate and monoclonal antibody portfolio. The Virginia facility is part of the company’s $50 billion in U.S. capital expansion commitments since 2020. Through this facility, Eli Lilly will boost its domestic manufacturing of antibody-drug conjugates (ADCs).

The company expects the facility to be completed within the next five years. The manufacturing site is expected to create nearly 650 new high-paying jobs in Virginia, while bringing 1,800 construction jobs to the region and boosting the local economy. Bansal also remains positive about the company’s potential for its therapies.

On September 17, the company reported that Mounjaro, Eli’s GIP/HLP-1 dual receptor agonist, in children and adolescents with type 2 diabetes showed positive results during the first phase 3 trial. The trial met the primary and all key secondary endpoints at week 30, achieving notable improvements in A1C and BMI compared to placebo.

Eli Lilly and Company (NYSE:LLY) is a medicine company that is engaged in the discovery, development, manufacturing, and marketing of products in the human pharmaceutical products segment. Eli Lilly’s recently introduced TuneLab consists of AI models and proprietary data obtained at a cost of over $1 billion. The company has invested in AI to provide biotech companies with the required models to offer research data to accelerate drug development.

7. Alphabet Inc. (NASDAQ:GOOGL)

Percentage of Portfolio Holding: 1.12%

Portfolio Holding Value: $8.27 Billion

Number of Hedge Fund Holders: 219

Alphabet Inc. (NASDAQ:GOOGL) is one of the best AI stocks to buy according to Goldman Sachs. On September 18, Alphabet Inc. (NASDAQ:GOOGL) announced that it is rolling Gemini into Chrome for Mac and Windows desktop users in the U.S.

Alphabet is advancing Chrome functions with the integration of its AI model, Gemini. Users can now use Gemini to minimize their tasks and instead of spending hours between sources, and trying to connect the dots. The AI tool can now answer questions about articles and find references within YouTube videos. Alphabet said that Gemini will soon be able to assist users in finding pages they have visited so they can pick up exactly where they left off.

It will also be available to businesses in the coming weeks via Google Workspace, including enterprise-grade data protections and controls. Gemini in Chrome will soon be available to mobile users in the U.S. In the coming months, Google will introduce agentic capabilities to Gemini in Chrome, allowing the AI tool to handle time-consuming tasks.

Alphabet Inc. (NASDAQ:GOOGL) is a holding company and operates through segments including Google Services, Google Cloud, and Other Bets. The company is heavily investing in Generative AI, enhancing its ability to integrate advanced AI functionality across core product lines.

6. Broadcom Inc. (NASDAQ:AVGO)

Percentage of Portfolio Holding: 1.39%

Portfolio Holding Value: $10.24 Billion

Number of Hedge Fund Holders: 156

Broadcom Inc. (NASDAQ:AVGO) is one of the best AI stocks to buy according to Goldman Sachs. On September 16, J.P. Morgan reiterated a Buy rating on Broadcom Inc. (NASDAQ:AVGO), keeping the price target at $400.

J.P. Morgan analyst Harlan Sur remains optimistic about AVGO following his discussion with Broadcom’s CFO Kirsten Spears. Sur is impressed with how strongly Broadcom is positioning itself in the AI-driven era. AI demand remains robust, and Broadcom is confident that each of its customer engagements could potentially scale to one million XPU AI clusters.

Sur pointed to Broadcom’s ambitious $120 billion AI revenue target by 2030, highlighting the company’s history of outpacing goals. He also noted the company’s momentum in product technology, with Broadcom on track to tape-out its first-generation 2nm/3.5D package AI XPU products in 2025 for a prospective customer. This achievement positions the company ahead of merchant GPU competitors as the clear technology leader.

As of September 23, Broadcom Inc. (NASDAQ:AVGO) average price target of $382.50, based on analysts’ estimates, implies an upside of almost 15.85% from current levels.

Broadcom Inc. (NASDAQ:AVGO) is a technology firm that designs, develops, and supplies a range of semiconductor, enterprise software, and security solutions. The company is a major AI infrastructure player, specializing in custom AI chips, networking, and optical interconnects.

5. Amazon.com, Inc. (NASDAQ:AMZN)

Percentage of Portfolio Holding: 1.63%

Portfolio Holding Value: $12.03 Billion

Number of Hedge Fund Holders: 335

Amazon.com, Inc. (NASDAQ:AMZN) is one of the best AI stocks to buy according to Goldman Sachs. On September 17, Amazon.com, Inc. (NASDAQ:AMZN) introduced a new AI agent to assist third-party merchants in operating their online businesses.

Amazon is adding agentic capabilities to its AI tool for third-party sellers, Seller Assistant. Amazon has released several third-party AI seller tools, such as a product listing generator and an image and video generator for ads. The latest update to its seller tools brings new and advanced AI-powered solutions to help sellers move faster to launch new products with more confidence.

Other key features of the AI seller tool include launching with less inventory while keeping fast speeds, improved storytelling to help minimize costs, providing fast and accurate signals for new product success, and accelerating product reviews.

Amazon believes that tools such as Seller Assistant allow merchants to focus more on product innovation and customer relationships, while AI tools handle the hard operational tasks, leading to higher sales.

Amazon’s vice president of worldwide selling partner services, Dharmesh Mehta, told CNBC in an interview that 1.3 million third-party sellers have already used its generative AI listing tools this week.

Amazon.com, Inc. (NASDAQ:AMZN) operates the world’s largest e-commerce platform and also engages in advertising and subscription services through online and physical stores. The company’s AI tools and machine learning models help its sellers to enhance businesses and improve customer experience.

4. Meta Platforms, Inc. (NASDAQ:META)

Percentage of Portfolio Holding: 1.65%

Portfolio Holding Value: $12.15 Billion

Number of Hedge Fund Holders: 260

Meta Platforms, Inc. (NASDAQ:META) is one of the best AI stocks to buy according to Goldman Sachs. On September 18, Meta Platforms, Inc. (NASDAQ:META) received its first autonomous CA-1 robot deployment in Germany.

Meta Platforms completed its first-ever deployment of the next-generation CA-1 robot from Circus SE. The deployment will begin with complete integration at Meta’s Munich offices and will be accompanied by a joint launch event.

“Together, with Meta’s AI models, we are additionally unlocking next-level intelligence for agentic operations — deeply integrated into our robotic and AI ecosystem,” said Nikolas Bullwinkel, CEO and Founder of Circus.

Along with the robot’s deployment, Circus agentic AI solutions will integrate with Meta’s foundational AI models to enhance hybrid user interaction, intelligent supply, demand predictions, and development of new operator AI agents for process automation.

At the same time, Meta Platforms’ CEO Mark Zuckerberg is in talks to license content from publishers to use with its AI services. The AI boom has increased demand for such services, including the chatbots Meta offers to its users. The licensing deals with publishers can allow Meta’s chatbot to offer real-time news updates and provide in-depth insights into world affairs.

Meta Platforms, Inc. (NASDAQ:META) is connecting people through its social media platforms, along with its VR and MR headsets, augmented reality, and wearables. The company is building human connections, powered by AI and immersive technologies.

3. Apple Inc. (NASDAQ:AAPL)

Percentage of Portfolio Holding: 2.53%

Portfolio Holding Value: $18.65 Billion

Number of Hedge Fund Holders: 156

Apple Inc. (NASDAQ:AAPL) is one of the best AI stocks to buy according to Goldman Sachs. On September 17, Tigress Financial raised the price target on Apple Inc. (NASDAQ:AAPL) from $300 to $305, keeping its Buy rating on the stock.

Ivan Feinseth from Tigress Financial upgraded the price target following the company’s recent launch event and the expansion of its ecosystem. Feinseth pointed to Apple’s inclusion of new products this year and its services growth.

JP Morgan analyst Samik Chatterjee also reiterates a Buy rating on AAP, however, without a price target. Chatterjee mentioned that Apple’s lead time following its initial iPhone 17 pre-orders on September 12, on average, has increased by four days across the lineup. This is driven by 7 days of expansion for iPhone 17, three days for Air, five days for 17 Pro, and two days for 17 Pro Max.

Apple’s lead times are tracking higher compared to the iPhone 16 cycle, as per Chatterjee. The analyst expects the base model, iPhone 17, to be the key force driving the highest upside surprise. As of September 23, Apple Inc.’s (NASDAQ:AAPL) average price target of $247.50, based on analysts’ estimates, implies a downside of almost 3.35% from current levels. Whereas, Tigress Financial’s price target of $305 indicates an upside of nearly 19.20% from current levels.

Apple Inc. (NASDAQ:AAPL) designs, manufactures, and sells smartphones, personal computers, and other electronic wearables and accessories. The company is investing heavily in AI infrastructure and personnel. Apple has introduced ‘Apple Intelligence’ to provide AI features across its lineup.

2. Microsoft Corporation (NASDAQ:MSFT)

Percentage of Portfolio Holding: 3.16%

Portfolio Holding Value: $23.24 Billion

Number of Hedge Fund Holders: 294

Microsoft Corporation (NASDAQ:MSFT) is one of the best AI stocks to buy according to Goldman Sachs. On September 17, Microsoft Corporation (NASDAQ:MSFT) announced an agreement with AI hyperscaler Nscale and Aker worth $6.2 billion.

The three companies are collaborating on a project to provide sustainable AI infrastructure for all of Europe. The deal between Microsoft, Nscale, and Aker will revolutionize the new build-out of renewable, scalable next-generation AI infrastructure in Northern Norway. The 5-year agreement will focus on meeting the exponentially growing demand in the region. The agreement will begin to deliver services in stages, starting in 2026. The project will offer advanced AI infrastructure powered entirely by renewable energy in a secure grid capacity.

“We are incredibly excited for what this means for our customers, in Norway and across Europe, providing the latest and most advanced AI services from Microsoft. It is inspiring to see how Nscale and Aker are building cutting-edge, sustainable AI infrastructure, and adding this facility to our comprehensive Microsoft cloud offering in Europe demonstrates our unwavering commitment to customers on the continent,” said Jon Tinter, president of business development and ventures for Microsoft.

The location is full of abundant hydropower and will assist the production of large-scale datacenter operations at affordable energy prices, supported by a cool climate and established industrial infrastructure.

Microsoft Corporation (NASDAQ:MSFT) is a technology giant with its leading services in AI. The company integrates AI across its cloud, software, and developer tools and offers AI services and infrastructure.

1. NVIDIA Corporation (NASDAQ:NVDA)

Percentage of Portfolio Holding: 3.43%

Portfolio Holding Value: $25.28 Billion

Number of Hedge Fund Holders: 235

NVIDIA Corporation (NASDAQ:NVDA) is one of the best AI stocks to buy according to Goldman Sachs. On September 22, BofA reiterated its Buy rating on NVIDIA Corporation (NASDAQ:NVDA), keeping the price target at $235.

Vivek Arya from BofA retained the rating on NVDA following the company’s plan to invest $100 billion in OpenAI. The analyst remains optimistic on NVIDIA as he believes that this investment will yield a significant return on investment, potentially returning $300 to $500 billion in revenue over time. This investment positions NVIDIA to be a key strategic compute and networking partner of OpenAI, enhancing its competitive advantage over its peers, such as Broadcom and AMD.

Moreover, NVIDIA Corporation’s (NASDAQ:NVDA) strong positioning in the rapidly growing AI sector, driven by a compelling valuation, supports Arya’s Overweight rating on the stock. The company’s robust FCF margins and major investments in the ecosystem are projected to expand its addressable market and accelerate product development in AI, adding to its growth prospects. NVIDIA’s CEO Jensen Huang has mentioned on several occasions that the investors have confidence in the company’s future to strengthen its supply chain partners.

NVIDIA Corporation (NASDAQ:NVDA) is a full-stack computing infrastructure company. It stands at the center stage of this AI era as the company’s Compute & Networking segment offers its Data Center, driven by computing platforms, AI solutions, and software.

While we acknowledge the potential of NVDA to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than NVDA and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.