The market has been volatile in the last few months as the Federal Reserve continued its rate cuts and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points over the last 12 months. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q2 and the beginning of Q3. In this article, we analyze what the smart money thinks of Gaming and Leisure Properties Inc (NASDAQ:GLPI) and find out how it is affected by hedge funds’ moves.

Hedge fund interest in Gaming and Leisure Properties Inc (NASDAQ:GLPI) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare GLPI to other stocks including Graco Inc. (NYSE:GGG), Tyler Technologies, Inc. (NYSE:TYL), and Crown Holdings, Inc. (NYSE:CCK) to get a better sense of its popularity. Our calculations also showed that GLPI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are assumed to be unimportant, old financial tools of the past. While there are over 8000 funds with their doors open at the moment, We hone in on the top tier of this group, approximately 750 funds. Most estimates calculate that this group of people administer the majority of the smart money’s total capital, and by watching their unrivaled picks, Insider Monkey has revealed a few investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to view the new hedge fund action encompassing Gaming and Leisure Properties Inc (NASDAQ:GLPI).

What does smart money think about Gaming and Leisure Properties Inc (NASDAQ:GLPI)?

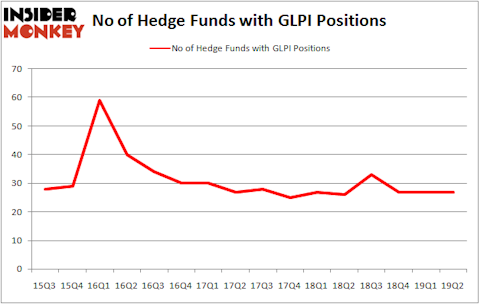

Heading into the third quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in GLPI over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Gaming and Leisure Properties Inc (NASDAQ:GLPI) was held by Renaissance Technologies, which reported holding $321.1 million worth of stock at the end of March. It was followed by Gates Capital Management with a $122.5 million position. Other investors bullish on the company included Citadel Investment Group, Cardinal Capital, and Two Sigma Advisors.

Judging by the fact that Gaming and Leisure Properties Inc (NASDAQ:GLPI) has witnessed falling interest from the aggregate hedge fund industry, logic holds that there is a sect of hedge funds that decided to sell off their entire stakes last quarter. Intriguingly, David Costen Haley’s HBK Investments said goodbye to the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling about $4.6 million in stock. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also sold off its stock, about $1.2 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Gaming and Leisure Properties Inc (NASDAQ:GLPI) but similarly valued. These stocks are Graco Inc. (NYSE:GGG), Tyler Technologies, Inc. (NYSE:TYL), Crown Holdings, Inc. (NYSE:CCK), and Lear Corporation (NYSE:LEA). This group of stocks’ market valuations match GLPI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GGG | 24 | 203550 | 6 |

| TYL | 24 | 540132 | -7 |

| CCK | 35 | 877153 | -3 |

| LEA | 31 | 843807 | -9 |

| Average | 28.5 | 616161 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $616 million. That figure was $783 million in GLPI’s case. Crown Holdings, Inc. (NYSE:CCK) is the most popular stock in this table. On the other hand Graco Inc. (NYSE:GGG) is the least popular one with only 24 bullish hedge fund positions. Gaming and Leisure Properties Inc (NASDAQ:GLPI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately GLPI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); GLPI investors were disappointed as the stock returned -0.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.