Will the new coronavirus cause a recession in US in the next 6 months? On February 27th, we put the probability at 75% and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Ford Motor Company (NYSE:F).

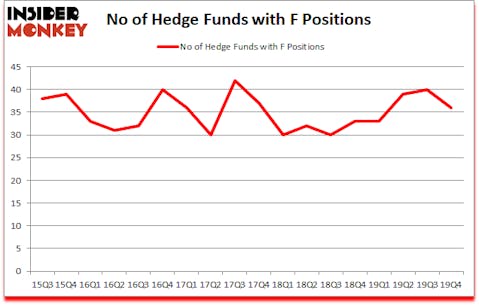

Ford Motor Company (NYSE:F) investors should pay attention to a decrease in hedge fund interest recently. Our calculations also showed that F isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

At the moment there are dozens of gauges investors put to use to assess publicly traded companies. A couple of the most innovative gauges are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the best fund managers can beat the broader indices by a very impressive margin (see the details here).

Bruce Kovner of Caxton Associates LP

We leave no stone unturned when looking for the next great investment idea. For example, COVID-19 pandemic is still the main driver of stock prices. So we are checking out this trader’s corona catalyst trades. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s analyze the key hedge fund action regarding Ford Motor Company (NYSE:F).

What have hedge funds been doing with Ford Motor Company (NYSE:F)?

At the end of the fourth quarter, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards F over the last 18 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Greenhaven Associates, managed by Edgar Wachenheim, holds the largest position in Ford Motor Company (NYSE:F). Greenhaven Associates has a $318 million position in the stock, comprising 7.1% of its 13F portfolio. On Greenhaven Associates’s heels is Pzena Investment Management, led by Richard S. Pzena, holding a $293.4 million position; 1.4% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish include Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, D. E. Shaw’s D E Shaw and Panayotis Takis Sparaggis’s Alkeon Capital Management. In terms of the portfolio weights assigned to each position Greenhaven Associates allocated the biggest weight to Ford Motor Company (NYSE:F), around 7.09% of its 13F portfolio. Ellington is also relatively very bullish on the stock, earmarking 5.03 percent of its 13F equity portfolio to F.

Judging by the fact that Ford Motor Company (NYSE:F) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there were a few fund managers who sold off their entire stakes in the third quarter. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the biggest investment of the “upper crust” of funds tracked by Insider Monkey, worth about $7.8 million in stock. Ben Levine, Andrew Manuel and Stefan Renold’s fund, LMR Partners, also dumped its stock, about $1.2 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 4 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Ford Motor Company (NYSE:F). We will take a look at Roper Technologies, Inc. (NYSE:ROP), Occidental Petroleum Corporation (NYSE:OXY), The Allstate Corporation (NYSE:ALL), and Constellation Brands, Inc. (NYSE:STZ). This group of stocks’ market caps are closest to F’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROP | 40 | 1248081 | -1 |

| OXY | 44 | 2305548 | -18 |

| ALL | 37 | 1712738 | -11 |

| STZ | 52 | 1980100 | 6 |

| Average | 43.25 | 1811617 | -6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43.25 hedge funds with bullish positions and the average amount invested in these stocks was $1812 million. That figure was $1104 million in F’s case. Constellation Brands, Inc. (NYSE:STZ) is the most popular stock in this table. On the other hand The Allstate Corporation (NYSE:ALL) is the least popular one with only 37 bullish hedge fund positions. Compared to these stocks Ford Motor Company (NYSE:F) is even less popular than ALL. Hedge funds dodged a bullet by taking a bearish stance towards F. Our calculations showed that the top 10 most popular hedge fund stocks returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but managed to beat the market by 12.9 percentage points. Unfortunately F wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was very bearish); F investors were disappointed as the stock returned -46.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.