Is Equitrans Midstream Corporation (NYSE:ETRN) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Hedge fund interest in Equitrans Midstream Corporation (NYSE:ETRN) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare ETRN to other stocks including Tech Data Corp (NASDAQ:TECD), UniFirst Corp (NYSE:UNF), and Corelogic Inc (NYSE:CLGX) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a large number of gauges investors employ to value publicly traded companies. A duo of the most innovative gauges are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best money managers can beat the S&P 500 by a healthy margin (see the details here).

Michael Lowenstein of Kensico Capital

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind let’s check out the fresh hedge fund action surrounding Equitrans Midstream Corporation (NYSE:ETRN).

What have hedge funds been doing with Equitrans Midstream Corporation (NYSE:ETRN)?

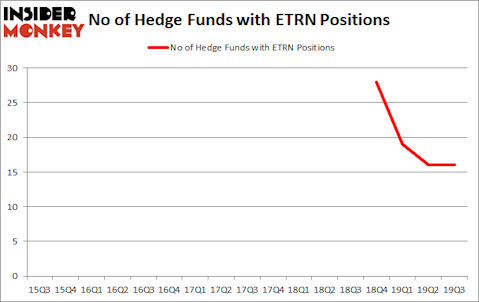

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ETRN over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Kensico Capital, managed by Michael Lowenstein, holds the most valuable position in Equitrans Midstream Corporation (NYSE:ETRN). Kensico Capital has a $117.6 million position in the stock, comprising 2.2% of its 13F portfolio. Coming in second is David Cohen and Harold Levy of Iridian Asset Management, with a $100.1 million position; 1.6% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions contain Steve Cohen’s Point72 Asset Management, Israel Englander’s Millennium Management and Jonathan Kolatch’s Redwood Capital Management. In terms of the portfolio weights assigned to each position Yaupon Capital allocated the biggest weight to Equitrans Midstream Corporation (NYSE:ETRN), around 4.12% of its 13F portfolio. Kensico Capital is also relatively very bullish on the stock, setting aside 2.25 percent of its 13F equity portfolio to ETRN.

Because Equitrans Midstream Corporation (NYSE:ETRN) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of fund managers that decided to sell off their positions entirely heading into Q4. Intriguingly, Matt Sirovich and Jeremy Mindich’s Scopia Capital dumped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $133.7 million in stock. Joshua Friedman and Mitchell Julis’s fund, Canyon Capital Advisors, also sold off its stock, about $31.7 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Equitrans Midstream Corporation (NYSE:ETRN) but similarly valued. These stocks are Tech Data Corp (NASDAQ:TECD), UniFirst Corp (NYSE:UNF), Corelogic Inc (NYSE:CLGX), and Coherent, Inc. (NASDAQ:COHR). All of these stocks’ market caps resemble ETRN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TECD | 21 | 450204 | 3 |

| UNF | 23 | 195066 | 0 |

| CLGX | 28 | 370528 | 5 |

| COHR | 17 | 227281 | -2 |

| Average | 22.25 | 310770 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $311 million. That figure was $335 million in ETRN’s case. Corelogic Inc (NYSE:CLGX) is the most popular stock in this table. On the other hand Coherent, Inc. (NASDAQ:COHR) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Equitrans Midstream Corporation (NYSE:ETRN) is even less popular than COHR. Hedge funds dodged a bullet by taking a bearish stance towards ETRN. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ETRN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ETRN investors were disappointed as the stock returned -28.7% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.